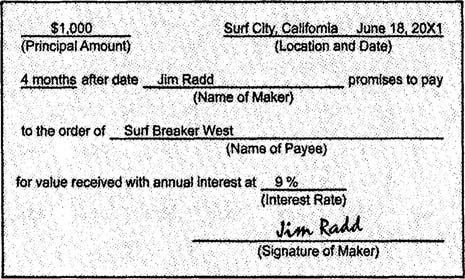

Companies classify the promissory notes they hold as notes receivable. A simple promissory note appears below.

The face value of a note is called the principal, which equals the initial amount of credit provided. The maker of a note is the party who receives the credit and promises to pay the note's holder. The maker classifies the note as a note payable. The payee is the party that holds the note and receives payment from the maker when the note is due. The payee classifies the note as a note receivable.

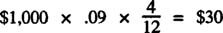

Calculating interest. Notes generally specify an interest rate, which is used to determine how much interest the maker of the note must pay in addition to the principal. Interest on short‐term notes is calculated according to the following formula:

For example, interest on a four-month, 9%, $1,000 note equals $30.

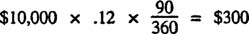

When a note's due date is expressed in days, the specified number of days is divided by 360 or 365 in the interest calculation. You may see either of these figures because accountants used a 360‐day year to simplify their calculations before computers and calculators became widely available, and many textbooks still follow this convention. In current practice, however, financial institutions and other companies generally use a 365‐day year to calculate interest. Therefore, you should be prepared to calculate interest either way.

The interest on a 90‐day, 12%, $10,000 note equals $300 if a 360‐day year is used to calculate interest, and the interest equals $295.89 if a 365‐day year is used.

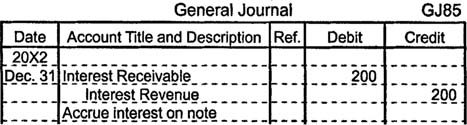

Even when a note's due date is not expressed in days, adjusting entries that recognize accrued interest are often calculated in terms of days. Suppose a company holds a four‐month, 10%, $10,000 note dated October 19, 20X2. If the company uses an annual accounting period that ends on December 31, an adjusting entry that recognizes 73 days of accrued interest revenue must be made on December 31, 20X2. To determine the number of days in this situation, subtract the date of issue from the number of days in October and then add the result to the number of days in November and December (31 ‐ 19 = 12; 12 + 30 + 31 = 73). Notice that when you count days, you omit the note's issue date but include the note's due date or, in this situation, the date that the adjusting entry is made. Assuming the interest calculation uses a 365‐day year, the accrued interest revenue equals $200.

The adjusting entry debits interest receivable and credits interest revenue.

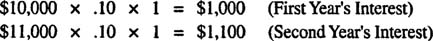

Interest on long‐term notes is calculated using the same formula that is used with short‐term notes, but unpaid interest is usually added to the principal to determine interest in subsequent years. For example, a two‐year, 10%, $10,000 note accrues $1,000 in interest during the first year. The principal and first year's interest equal $11,000 when compounded, so $1,100 in interest accrues during the second year.