Timber, fossil, mineral deposits, and other natural resources are different from depreciable assets because they are physically extracted during company operations and they are replaceable only through natural processes.

Cost of natural resources. The cost of natural resources includes all costs necessary to acquire the resource and prepare it for extraction. If the property must be restored after the natural resources are removed, the restoration costs are also considered to be part of the cost.

Companies that search for new natural resources determine cost using one of two approaches: the successful‐efforts approach or the full‐cost approach. Under the successful‐efforts approach, exploration costs are considered part of the cost of natural resources only when a productive natural resource is found. Unsuccessful exploration costs are treated as expenses in the period during which they occur. Under the full‐cost approach, all exploration costs are included in the cost of natural resources. The approach that a company selects should be disclosed in the notes that accompany the financial statements.

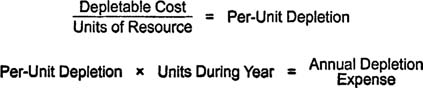

Depletion. Depletion is the process of allocating the depletable cost of natural resources to expense as individual units of the resource are extracted. Depletable cost equals the total cost of natural resources less any salvage value remaining after the company finishes extracting them. Depletion expense is generally calculated using the units‐of‐activity method. Under this method, a per‐unit cost of depletion is found by dividing the depletable cost by the estimated number of units the resource contains. The per‐unit cost times the actual number of units extracted and sold in one year equals the amount of depletion expense recorded for the asset during that year.

Calculating Units‐of‐Activity Depletion

![]()

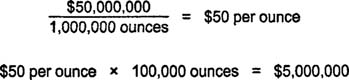

Suppose a company pays $50,000,000 for an existing gold mine estimated to contain 1,000,000 ounces of gold. The mine has no salvage value, so the depletable cost of $50,000,000 is divided by 1,000,000 ounces to calculate a per‐unit depletion cost of $50 per ounce. If the company extracts and then sells 100,000 ounces of gold during the year, depletion expense equals $5,000,000.

Calculating Units‐of‐Activity Depletion

![]()

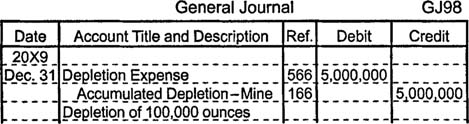

One way to record depletion expense of $5,000,000 is to debit depletion expense for $5,000,000 and credit accumulated depletionmine for $5,000,000.

![]()

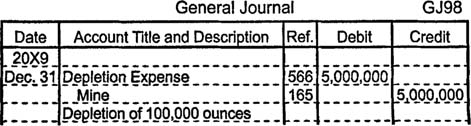

Instead of using a contra‐asset account to record accumulated depletion, companies may also decrease the balance of natural resources directly. Therefore, depletion expense of $5,000,000 might be recorded by debiting depletion expense for $5,000,000 and crediting the gold mine for $5,000,000.