Unearned revenues are payments for future services to be performed or goods to be delivered. Advance customer payments for newspaper subscriptions or extended warranties are unearned revenues at the time of sale. At the end of each accounting period, adjusting entries must be made to recognize the portion of unearned revenues that have been earned during the period.

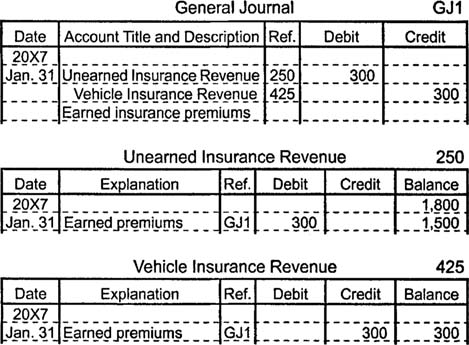

Suppose a customer pays $1,800 for an insurance policy to protect her delivery vehicles for six months. Initially, the insurance company records this transaction by increasing an asset account (cash) with a debit and by increasing a liability account (unearned revenue) with a credit. After one month, the insurance company makes an adjusting entry to decrease (debit) unearned revenue and to increase (credit) revenue by an amount equal to one sixth of the initial payment.

Accounting records that do not include adjusting entries to show the earning of previously unearned revenues overstate total liabilities and understate total revenues and net income.