Intangible assets include patents, copyrights, trademarks, trade names, franchise licenses, government licenses, goodwill, and other items that lack physical substance but provide long‐term benefits to the company. Companies account for intangible assets much as they account for depreciable assets and natural resources. The cost of intangible assets is systematically allocated to expense during the asset's useful life or legal life, whichever is shorter, and this life is never allowed to exceed forty years. The process of allocating the cost of intangible assets to expense is called amortization, and companies almost always use the straight‐line method to amortize intangible assets.

Patents. Patents provide exclusive rights to produce or sell new inventions. When a patent is purchased from another company, the cost of the patent is the purchase price. If a company invents a new product and receives a patent for it, the cost includes only registration, documentation, and legal fees associated with acquiring the patent and defending it against unlawful use by other companies. Research and development costs, which are spent to improve existing products or create new ones, are never included in the cost of a patent; such costs are recorded as operating expenses when they are incurred because of the uncertainty surrounding the benefits they will provide.

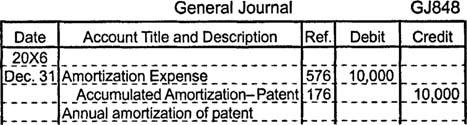

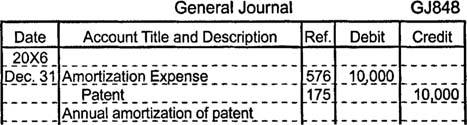

The legal life of a patent is seventeen years, which often exceeds the patent's useful life. Suppose a company buys an existing, five‐year‐old patent for $100,000. The patent's remaining legal life is twelve years. If the company believes the patent's remaining useful life is only ten years, they use the straight‐line method to calculate that $10,000 ($100,000 ÷ 10 = $10,000) must be recorded as amortization expense each year.

One way to record amortization expense of $10,000 is to debit amortization expense for $10,000 and credit accumulated amortization‐patent for $10,000.

Instead of using a contra‐asset account to record accumulated amortization, most companies decrease the balance of the intangible asset directly. In such cases, amortization expense of $10,000 is recorded by debiting amortization expense for $10,000 and crediting the patent for $10,000.

A similar entry would be made to record amortization expense for each type of intangible asset. The entry would include a debit to amortization expense and a credit to the accumulated amortization or intangible asset account.

Copyrights. Companies amortize a variety of intangible assets, depending on the nature of the business. Copyrights provide their owner with the exclusive right to reproduce and sell artistic works, such as books, songs, or movies. The cost of copyrights includes a nominal registration fee and any expenditures associated with defending the copyright. If a copyright is purchased, the purchase price determines the amortizable cost. Although the legal life of a copyright is extensive, copyrights are often fully amortized within a relatively short period of time. The amortizable life of a copyright, like other intangible assets, may never exceed forty years.

Trademarks and trade names. Trademarks and trade names include corporate logos, advertising jingles, and product names that have been registered with the government and serve to identify specific companies and products. All expenditures associated with securing and defending trademarks and trade names are amortizable.

Franchise licenses. The purchaser of a franchise license receives the right to sell certain products or services and to use certain trademarks or trade names. These rights are valuable because they provide the purchaser with immediate customer recognition. Many fast‐food restaurants, hotels, gas stations, and automobile dealerships are owned by individuals who have paid a company for a franchise license. The cost of a franchise license is amortized over its useful life, often its contractual life, which is not to exceed forty years.

Government licenses. The purchaser of a government license receives the right to engage in regulated business activities. For example, government licenses are required to broadcast on specific frequencies and to transport certain materials. The cost of government licenses is amortizable in the same way as franchise licenses.

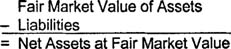

Goodwill. Goodwill equals the amount paid to acquire a company in excess of its net assets at fair market value. The excess payment may result from the value of the company's reputation, location, customer list, management team, or other intangible factors. Goodwill may be recorded only after the purchase of a company occurs because such a transaction provides an objective measure of goodwill as recognized by the purchaser. The value of goodwill is calculated by first subtracting the purchased company's liabilities from the fair market value (not the net book value) of its assets and then subtracting this result from the purchase price of the company.

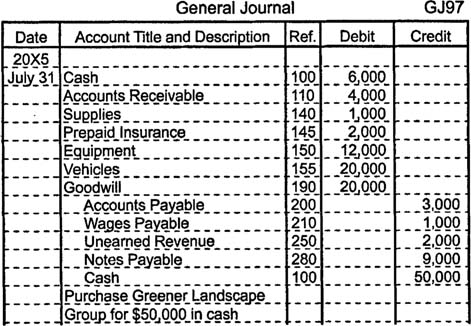

Suppose Yard Apes, Inc., purchases the Greener Landscape Group for $50,000. When the purchase takes place, the Greener Landscape Group has assets with a fair market value of $45,000 and liabilities of $15,000, so the company would seem to be worth only $30,000.

The Greener Landscape Group Fair Market Value of Assets and Liabilities July 31, 20X5

|

Assets

|

|

Liabilities

|

|

|

Cash

|

$ 6,000

|

Accounts Payable

|

$ 3,000

|

|

Accounts Receivable

|

4,000

|

Wages Payable

|

1,000

|

|

Supplies

|

1,000

|

Unearned Revenue

|

2,000

|

|

Prepaid Insurance

|

2,000

|

Notes Payable

|

9,000

|

|

Equipment

|

12,000

|

Total Liabilities

|

$15,000

|

|

Vehicles

|

20,000

|

|

|

|

Total Assets

|

$45,000

|

|

|

Since Yard Apes, Inc., is willing to pay $50,000, they must recognize that the Greener Landscape Group's value includes $20,000 in goodwill. Yard Apes, Inc., makes the following entry to record the purchase of the Greener Landscape Group.

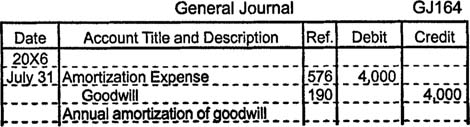

Yard Apes, Inc., believes the useful life of the goodwill is five years. Using the straight‐line method, Yard Apes, Inc., calculates that $4,000 in goodwill must be amortized each year ($20,000 ÷ 5 = $4,000). To record a full year's amortization expense, they debit amortization expense for $4,000 and credit goodwill for $4,000.