Under the double‐entry bookkeeping system, the full value of each transaction is recorded on the debit side of one or more accounts and also on the credit side of one or more accounts. Therefore, the combined debit balance of all accounts always equals the combined credit balance of all accounts.

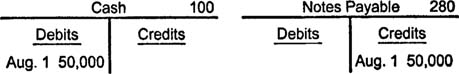

Suppose a new company obtains a long‐term loan for $50,000 on August 1. The company's cash account (an asset) increases by $50,000, so it is debited for this amount. Simultaneously, the company's notes payable account (a liability) increases by $50,000, so it is credited for this amount. Both sides of the accounting equation increase by $50,000, and total debits and credits remain equal.

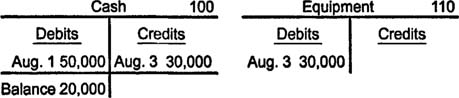

Some transactions affect only one side of the accounting equation, but the double‐entry bookkeeping system nevertheless ensures that the accounting equation remains in balance. For example, if the company pays $30,000 on August 3 to purchase equipment, the cash account's decrease is recorded with a $30,000 credit and the equipment account's increase is recorded with a $30,000 debit. These two asset‐account entries offset each other, so the accounting equation remains in balance. Since the cash balance was $50,000 before this transaction occurred, the company has $20,000 in cash after the equipment purchase.

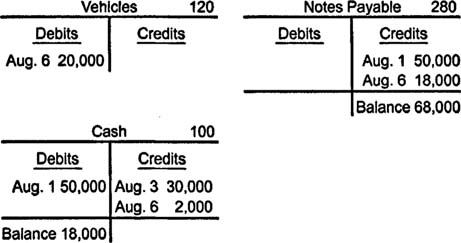

A compound entry is necessary when a single transaction affects three or more accounts. Suppose the company's owner purchases a used delivery truck for $20,000 on August 6 by making a $2,000 cash down payment and obtaining a three‐year note payable for the remaining $18,000. This transaction is recorded by debiting (increasing) the vehicles account for $20,000, crediting (increasing) the notes payable account for $18,000, and crediting (decreasing) the cash account for $2,000.

The debits and credits total $20,000, and the accounting equation remains in balance because the $18,000 net increase in assets is matched by an $18,000 increase in liabilities. After these three transactions, the company has $68,000 in assets (cash $18,000; equipment $30,000; vehicles $20,000) and $68,000 in liabilities (notes payable).