The Recording Process Illustrated

To understand how to record a variety of transactions, consider the description and analysis of the Greener Landscape Group's first thirteen transactions. Then see how each transaction appears in the company's general journal and general ledger accounts.

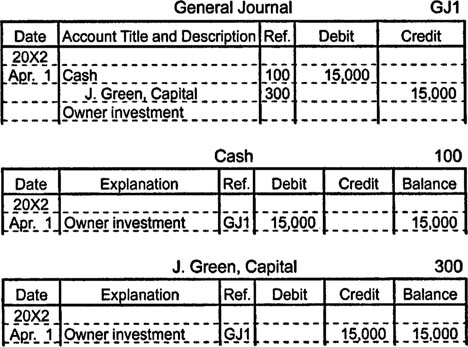

Transaction 1: On April 1, 20X2, the owner of the Greener Landscape Group, J. Green, invests $15,000 to open the business. Therefore, an asset account (cash) increases and is debited for $15,000, and the owner's capital account (J. Green, capital) increases and is credited for $15,000.

Notice that the cash account has a debit balance and the J. Green, capital account has a credit balance. Since both balances are normal, brackets are not used.

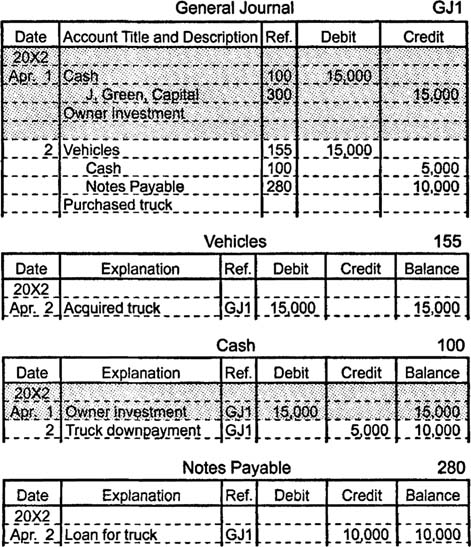

Transaction 2: On April 2, Mr. Green purchases a $15,000 used truck by paying $5,000 in cash and signing a $10,000 note payable, which is due in eighteen months. One asset account (vehicles) increases and is debited for $15,000. Another asset account (cash) decreases and is credited for $5,000. A liability account (notes payable) increases and is credited for $10,000.

The shaded areas below provide a reference for the transaction's position in the journal and ledger accounts. They are not part of the current entry.

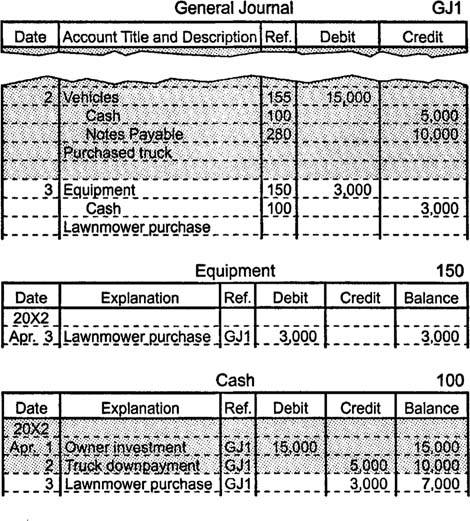

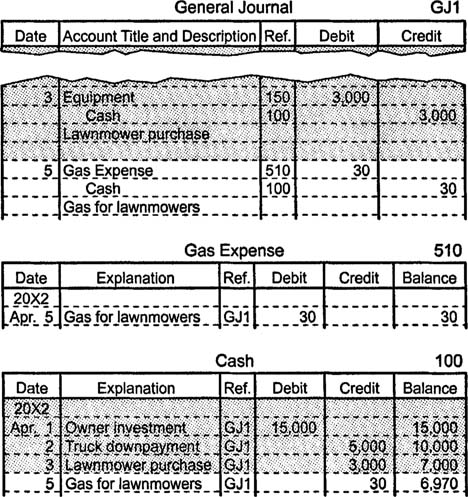

Transaction 3: On April 3, Mr. Green purchases lawn mowers for $3,000 in cash. One asset account (equipment) increases and is debited for $3,000, and another asset account (cash) decreases and is credited for $3,000.

Transaction 4: On April 5, Mr. Green purchases $30 worth of gasoline to power the mowers during April. Since the gas is a cost of doing business during the present accounting period, an expense account (gas expense) increases and is debited for $30. (Remember: increases in asset, expense, and drawing accounts are made with debit entries.) In addition, an asset account (cash) decreases and is credited for $30.

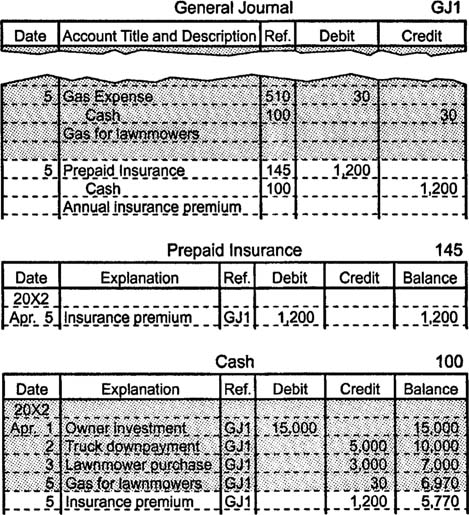

Transaction 5: On April 5, Mr. Green pays $1,200 for a one‐year insurance contract that protects his business from April 1 until March 31 of the following year. Given the length of time this contract is in effect, the matching principle requires that the contract's cost initially be recorded as an asset since it provides a future benefit. Therefore, an asset (prepaid insurance) increases and is debited for $1,200. Another asset account (cash) decreases and is credited for $1,200.

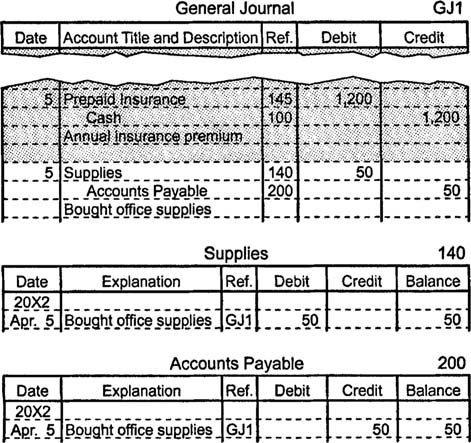

Transaction 6: On April 5, Mr. Green purchases $50 worth of office supplies, placing the purchase on his account with the store rather than paying cash. Supplies are a prepaid expense (an asset) until they are used and thereby become a cost of doing business (an expense). Therefore, an asset account (supplies) increases and is debited for $50. Since Mr. Green places the purchase on his account with the store, a liability account (accounts payable) increases and is credited for $50. Accounts payable differ from notes payable. Accounts payable are amounts the company owes based on the good credit of the company or the owner, whereas notes payable are amounts the company owes under formal obligations.

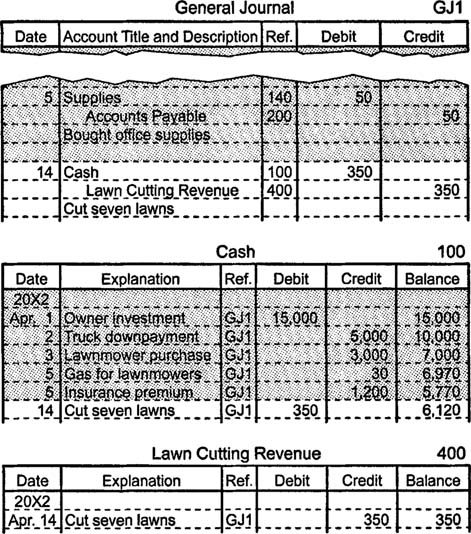

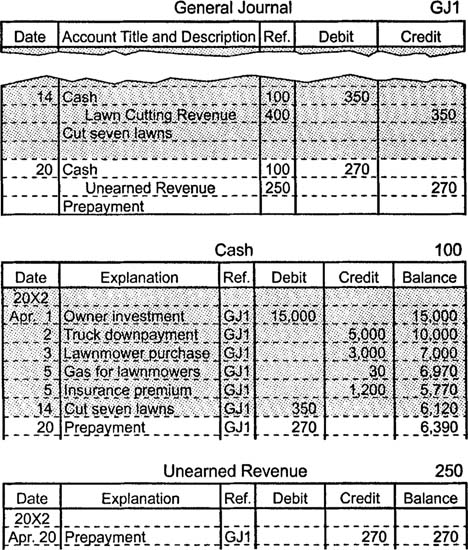

Transaction 7: On April 14, the Greener Landscape Group cuts grass for seven customers, receiving $50 from each. An asset account (cash) increases and is debited for $350, and a revenue account (lawn cutting revenue) increases and is credited for $350.

Transaction 8: On April 20, Mr. Green receives $270 from a customer for six future maintenance visits. An advance deposit from a customer is an obligation to perform work in the future. It is a liability until the work is performed, at which time it becomes revenue. Therefore, the advance deposit is called unearned revenue. An asset account (cash) increases and is debited for $270, and a liability account (unearned revenue) increases and is credited for $270.

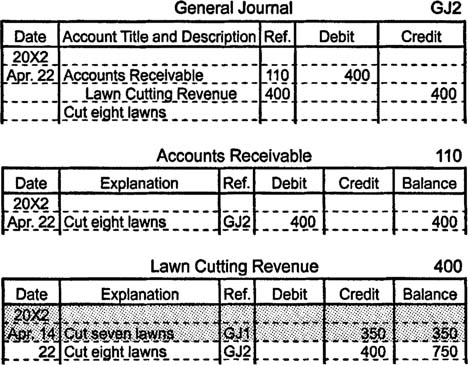

Transaction 9: On April 22, the Greener Landscape Group cuts grass for eight customers, billing each one $50 but receiving no cash. In accordance with the revenue recognition principle, revenue is recognized upon the completion of a service or the delivery of a product, even if no cash changes hands at that time. Therefore, an asset account (accounts receivable) increases and is debited for $400, and a revenue account (lawn cutting revenue) increases and is credited for $400.

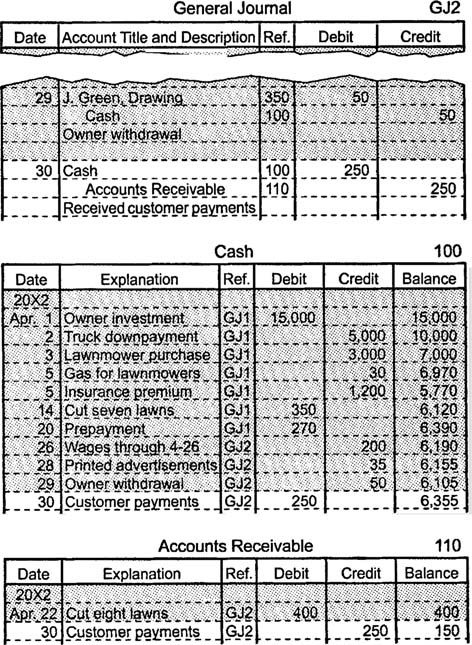

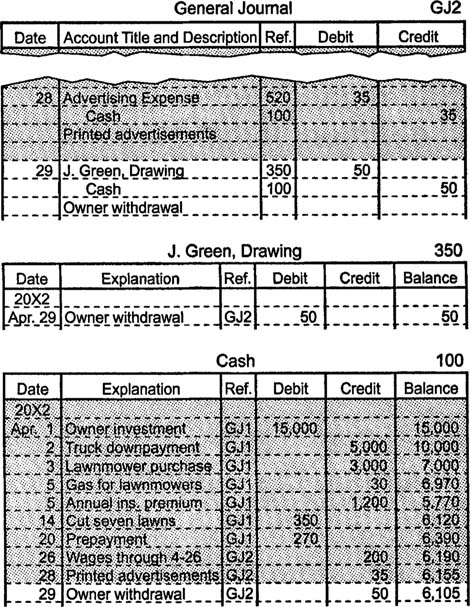

Notice the new journal page and the corresponding change in posting references on the accounts.

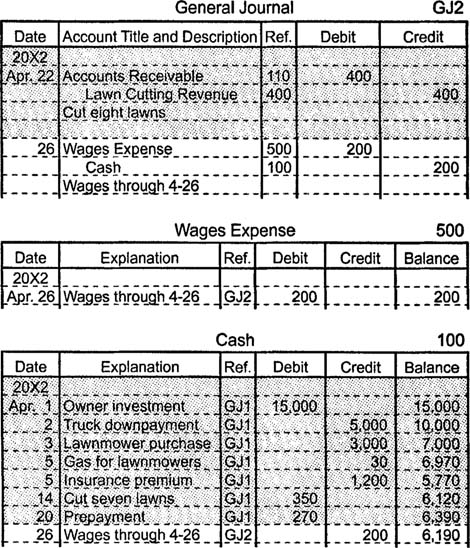

Transaction 10: On April 26, Mr. Green pays $200 in wages to a part‐time employee. An expense account (wages expense) increases and is debited for $200, and an asset account (cash) decreases and is credited for $200.

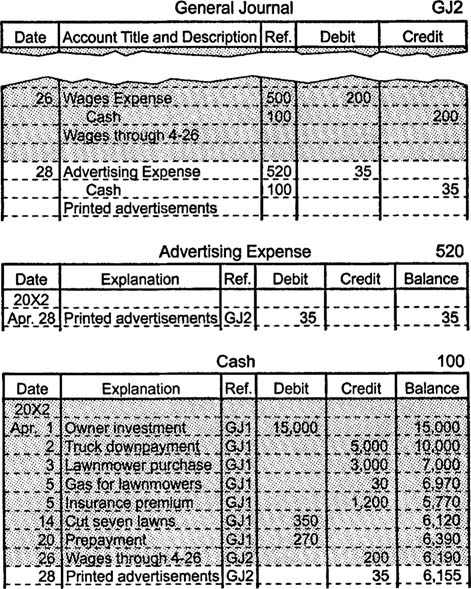

Transaction 11: On April 28, Mr. Green pays $35 to print advertising fliers. An expense account (advertising expense) increases and is debited for $35, and an asset account (cash) decreases and is credited for $35.

Transaction 12: On April 29, Mr. Green withdraws $50 for personal use. The owner's drawing account (J. Green, drawing) increases and is debited for $50, and an asset account (cash) decreases and is credited for $50.

Transaction 13: On April 30, five of the eight previously billed customers each pay $50. Therefore, one asset account (cash) increases and is debited for $250, and another asset account (accounts receivable) decreases and is credited for $250.