Inventory Systems: Perpetual or Periodic

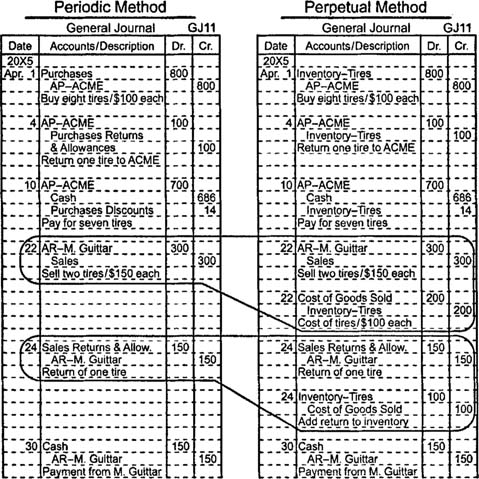

Companies may use either the perpetual system or the periodic system to account for inventory. Under the periodic system, merchandise purchases are recorded in the purchases account, and the inventory account balance is updated only at the end of each accounting period. Perpetual inventory systems have traditionally been associated with companies that sell small numbers of high‐priced items, but the development of modern scanning and computer technology has enabled almost any type of merchandiser to consider using this system.

Under the perpetual system, purchases, purchase returns and allowances, purchase discounts, sales, and sales returns are immediately recognized in the inventory account, so the inventory account balance should always remain accurate, assuming there is no theft, spoilage, or other losses. Consider several entries under both systems. The reference columns are removed from the illustration to simplify what you're seeing. (Note: Ap stands for accounts payable, and AR stands for accounts receivable.)

As the two sets of circled entries indicate, two things happen when there is a sale or a sales return. First, the sales transaction's effect on revenue must be recognized by making an entry to increase accounts receivable and the sales account. Second, the flow of merchandise between inventory (an asset) and cost of goods sold (an expense) is recorded in accordance with the matching principle. A sales return has the opposite effect on the same accounts. Under the periodic system, the inventory and cost of goods sold accounts are updated only periodically, but under the perpetual system, entries that recognize a transaction's effect on these accounts occur when the revenue from the sale is recognized.

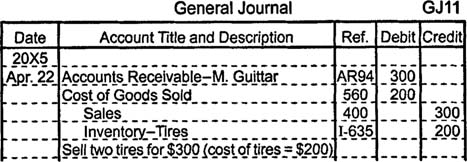

For convenience, a sale or sales return can be recorded under the perpetual system with a compound entry that lists all four accounts.

The general journal provides a simple, consistent format to present new information. However, most companies would record the sale in a sales journal.