The cost of items remaining in inventory and the cost of goods sold are easy to determine if purchase prices and other inventory costs never change, but price fluctuations may force a company to make certain assumptions about which items have sold and which items remain in inventory. There are four generally accepted methods for assigning costs to ending inventory and cost of goods sold: specific cost; average cost; first‐in, first‐out (FIFO); and last‐in, first‐out (LIFO). Each method is applied to the information in the following illustrations, summarizing the activity in one inventory subsidiary ledger account at a company named Zapp Electronics.

|

January 1

|

Beginning inventory–100 units @ $ 14/unit

|

|

March 20

|

Sale of 50 units

|

|

April 10

|

Purchase of 150 units @ $16/unit

|

|

July 15

|

Sale of 100 units

|

|

September 30

|

Sale of 50 units

|

|

October 10

|

Purchase of 200 units @ $ 17/unit

|

|

December 15

|

Sale of 150 units

|

|

December 31

|

Ending Inventory–100 units

|

The cost of goods available for sale equals the beginning value of inventory plus the cost of goods purchased. Two purchases occurred during the year, so the cost of goods available for sale is $ 7,200.

|

Units

|

|

Per Unit Cost

|

|

Total Cost

|

|

Beginning Inventory

|

100

|

×

|

$ 14

|

=

|

$ 1,400

|

|

+ Purchase–April 10

|

150

|

×

|

$ 16

|

=

|

2,400

|

|

+ Purchase–October 10

|

200

|

×

|

$ 17

|

=

|

3,400

|

|

= Cost of Goods Available for Sale

|

450

|

|

|

|

$ 7,200

|

Specific cost. Companies can use the specific cost method only when the purchase date and cost of each unit in inventory is identifiable. For the most part, companies that use this method sell a small number of expensive items, such as automobiles or appliances.

If specially coded price tags or some other technique enables Zapp Electronics to determine that 15 units in ending inventory were purchased on April 10 and the remaining 85 units were purchased on October 10, then the ending value of inventory and the cost of goods sold can be determined precisely.

|

Units

|

|

Per Unit Cost

|

|

Total Cost

|

|

+ Purchase–April 10

|

15

|

×

|

$16

|

=

|

240

|

|

Purchase–October 10

|

85

|

×

|

$17

|

=

|

1,445

|

|

Ending Inventory

|

100

|

$ 1,685

|

|

|

$ 7,200

|

|

Cost of Goods Available for Sale

|

$ 7,200

|

|

- Ending Inventory

|

(1,685)

|

|

= Cost of Goods Sold

|

$ 5,515

|

Since the specific cost of each unit is known, the resulting values for ending inventory and cost of goods sold are not affected by whether the company uses a periodic or perpetual system to account for inventory. The only difference between the systems is that the value of inventory and the cost of goods sold is determined every time a sale occurs under the perpetual system, and these amounts are calculated at the end of the accounting period under the periodic system. Check the value found for cost of goods sold by multiplying the 350 units that sold by their per unit cost.

|

Units

|

|

Per Unit Cost

|

|

Total Cost

|

|

Beginning Inventory

|

100

|

×

|

$ 14

|

=

|

$ 1,400

|

|

Purchase–April 10

|

135

|

×

|

$ 16

|

=

|

2,160

|

|

Purchase–October 10

|

115

|

×

|

$ 17

|

=

|

1,955

|

|

Cost of Goods Available for Sale

|

350

|

|

|

|

$5,515

|

Companies that sell a large number of inexpensive items generally do not track the specific cost of each unit in inventory. Instead, they use one of the other three methods to allocate inventoriable costs. These other methods (average cost, FIFO, and LIFO) are built upon certain assumptions about how merchandise flows through the company, so they are often referred to as assumed cost flow methods or cost flow assumptions. Accounting principles do not require companies to choose a cost flow method that approximates the actual movement of inventory items.

Average cost. Companies that use the periodic system and want to apply the same cost to all units in an inventory account use the weighted average cost method. The weighted average cost per unit equals the cost of goods available for sale divided by the number of units available for sale.

For Zapp Electronics, the cost of goods available for sale is $ 7,200 and the number of units available for sale is 450, so the weighted average cost per unit is $ 16.

The weighted average cost per unit multiplied by the number of units remaining in inventory determines the ending value of inventory. Subtracting this amount from the cost of goods available for sale equals the cost of goods sold.

|

Cost of Goods Available for Sale

|

$ 7,200

|

|

- Ending Inventory (100 × $ 16)

|

(1,600)

|

|

= Cost of Goods Sold

|

$ 5,600

|

Check the value found for cost of goods sold by multiplying the 350 units that sold by the weighted average cost per unit.

Companies that use the perpetual system and want to apply the average cost to all units in an inventory account use the moving average method. Every time a purchase occurs under this method, a new weighted average cost per unit is calculated and applied to the items.

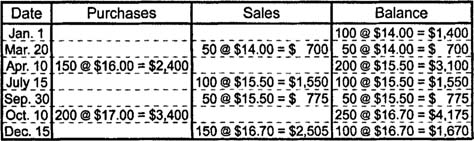

As the chart below indicates, the moving average cost per unit changes from $14.00 to $15.50 after the purchase on April 10 and becomes $16.70 after the purchase on October 10.

Use the final moving average cost per unit to calculate the ending value of inventory and the cost of goods sold.

|

Cost of Goods Available for Sale

|

$ 7,200

|

|

- Ending Inventory (100 × $ 16.70)

|

(1,670)

|

|

= Cost of Goods Sold

|

$ 5,530

|

First‐in, first‐out. The first‐in, first‐out (FIFO) method assumes the first units purchased are the first to be sold. In other words, the last units purchased are always the ones remaining in inventory. Using this method, Zapp Electronics assumes that all 100 units in ending inventory were purchased on October 10.

|

Cost of Goods Available for Sale

|

$ 7,200

|

|

- Ending Inventory (100 × $ 17)

|

(1,700)

|

|

= Cost of Goods Sold

|

$ 5,500

|

Check the value found for cost of goods sold by multiplying the 350 units that sold by their per unit cost.

|

Units

|

|

Per Unit Cost

|

|

Total Cost

|

|

Beginning Inventory

|

100

|

×

|

$ 14

|

=

|

$ 1,400

|

|

Purchase–April 10

|

150

|

×

|

$ 16

|

=

|

2,400

|

|

Purchase–October 10

|

100

|

×

|

$ 17

|

=

|

1,700

|

|

Cost of Goods Sold

|

350

|

|

|

|

$ 5,500

|

The first‐in, first‐out method yields the same result whether the company uses a periodic or perpetual system. Under the perpetual system, the first‐in, first‐out method is applied at the time of sale. The earliest purchases on hand at the time of sale are assumed to be sold.

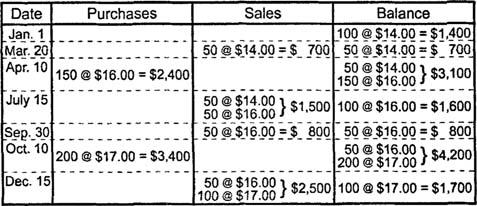

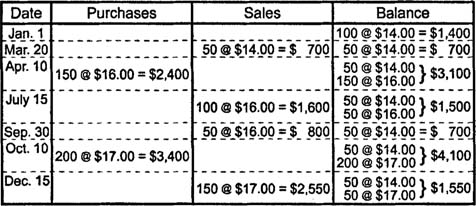

Last‐in, first‐out. The last‐in, first‐out (LIFO) method assumes the last units purchased are the first to be sold. Therefore, the first units purchased always remain in inventory. This method usually produces different results depending on whether the company uses a periodic or perpetual system.

If Zapp Electronics uses the last‐in, first‐out method with a periodic system, the 100 units remaining at the end of the period are assumed to be the same 100 units in beginning inventory.

|

Cost of Goods Available for Sale

|

$ 7,200

|

|

- Ending Inventory (100 × $ 14)

|

(1,400)

|

|

= Cost of Goods Sold

|

$ 5,800

|

Check the value found for cost of goods sold by multiplying the 350 units that sold by their per unit cost.

|

Units

|

|

Per Unit Cost

|

|

Total Cost

|

|

+ Purchase–April 10

|

200

|

×

|

$ 17

|

=

|

3,400

|

|

Purchased April 10

|

150

|

×

|

$ 16

|

=

|

2,400

|

|

Cost of Goods Sold

|

350

|

|

|

|

$ 5,800

|

If Zapp Electronics uses the last‐in, first‐out method with a perpetual system, the cost of the last units purchased is allocated to cost of goods sold whenever a sale occurs. Therefore, the assumption would be that the 50 units sold on March 20 came from beginning inventory, the units sold on July 15 and September 30 were all purchased on April 10, and the units sold on December 15 were all purchased on October 10. Therefore ending inventory consists of 50 units from beginning inventory and 50 units from the October 10 purchase.

|

Units

|

|

Per Unit Cost

|

|

Total Cost

|

|

Beginning Inventory

|

50

|

×

|

$ 14

|

=

|

$ 700

|

|

Purchase–April 10

|

150

|

×

|

$ 16

|

=

|

2,400

|

|

Purchase–October 10

|

150

|

×

|

$ 17

|

=

|

850

|

|

Ending Enventory

|

100

|

|

|

|

$ 1,500

|

|

Cost of Goods Available for Sale

|

$ 7,200

|

|

- Ending Inventory

|

(1,550)

|

|

= Cost of Goods Sold

|

$ 5,650

|

Check the value found for cost of goods sold by multiplying the 350 units that sold by their per unit cost.

|

Units

|

|

Per Unit Cost

|

|

Total Cost

|

|

Beginning Inventory

|

50

|

×

|

$ 14

|

=

|

$ 700

|

|

Purchase–April 10

|

150

|

×

|

$ 16

|

=

|

2,400

|

|

Purchase–October 10

|

150

|

×

|

$ 17

|

=

|

2,550

|

|

Cost of Goods Available for Sale

|

350

|

|

|

|

$5,650

|

Comparing the assumed cost flow methods. Although the cost of goods available for sale is the same under each cost flow method, each method allocates costs to ending inventory and cost of goods sold differently. Compare the values found for ending inventory and cost of goods sold under the various assumed cost flow methods in the previous examples.

|

Weighted Average (Periodic)

|

Moving Average (Perpetual)

|

FIFO (Periodic or Perpetual)

|

LIFO (Periodic)

|

LIFO (Perpetual)

|

|

Ending Inventory

|

$ 1,600

|

$ 1,670

|

$ 1,700

|

$ 1,400

|

$ 1,550

|

|

Cost of Goods Sold

|

5,600

|

5,530

|

5,500

|

5,800

|

5,650

|

|

Cost of Goods Available for Sale

|

$ 7,200

|

$ 7,200

|

$ 7,200

|

$ 7,200

|

$ 7,200

|

If the cost of goods sold varies, net income varies. Less net income means a smaller tax bill. In times of rising prices, LIFO (especially LIFO in a periodic system) produces the lowest ending inventory value, the highest cost of goods sold, and the lowest net income. Therefore, many companies in the United States use LIFO even if the method does not accurately reflect the actual flow of merchandise through the company. The Internal Revenue Service accepts LIFO as long as the same method is used for financial reporting purposes.