At the beginning of each accounting period, some accountants use reversing entries to cancel out the adjusting entries that were made to accrue revenues and expenses at the end of the previous accounting period. Reversing entries make it easier to record subsequent transactions by eliminating the need for certain compound entries.

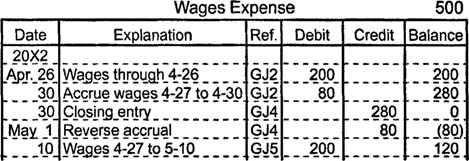

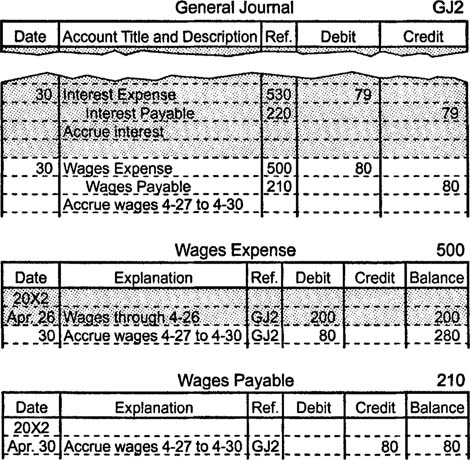

Suppose Mr. Green makes an adjusting entry at the end of April to account for $80 in unpaid wages. This adjustment involves an $80 debit to the wages expense account and an $80 credit to the wages payable account.

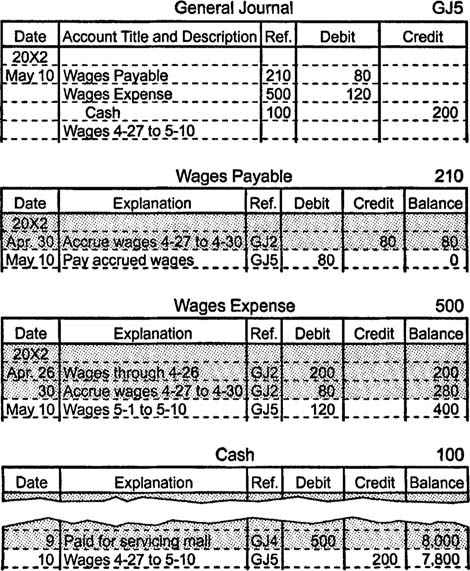

If Mr. Green does not reverse the adjusting entry, he must remember that part of May's first payroll payment (for work completed in April) has already been recorded in the wages payable and wages expense accounts. Assuming Mr. Green pays $200 in wages on May 10, he makes a compound entry that decreases (debits) wages payable to $0, increases (debits) wages expense by an amount equal to the wage expenses for May 1 through May 10, and decreases (credits) cash for an amount equal to the total payment.

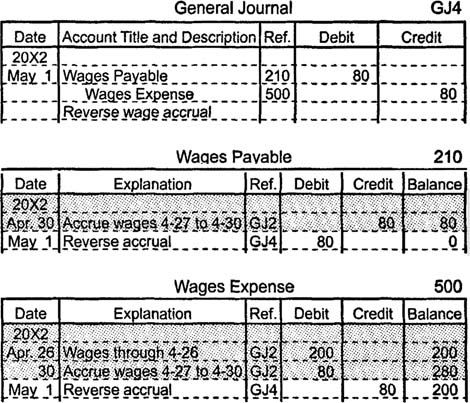

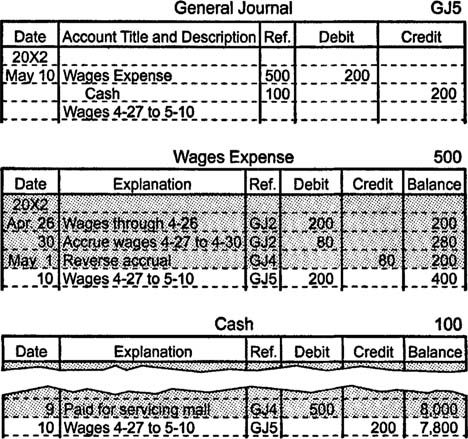

To avoid the need for a compound entry, Mr. Green may choose to reverse the April 30 adjustment for accrued wages when the May accounting period begins. The reversing entry decreases (debits) wages payable for $80 and decreases (credits) wages expense for $80.

If the reversing entry is made, the May 10 payroll payment can be recorded with a simple entry that increases (debits) wages expense for $200 and decreases (credits) cash for $200.

Between May 1 when the reversing entry is made and May 10 when the payroll entry is recorded, the company's total liabilities and total expenses are understated. This temporary inaccuracy in the books is acceptable only because financial statements are not prepared during this period.

When the temporary accounts are closed at the end of an accounting period, subsequent reversing entries create abnormal balances in the affected expense and revenue accounts. For example, if the wages expense account is closed on April 30, a reversing entry on May 1 creates a credit balance in the account. The credit balance is offset by the May 10 debit entry, and the account balance then shows current period expenses.