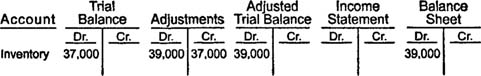

On a work sheet, the beginning inventory balance in the trial balance columns combines with the two inventory adjustments to produce the ending inventory balance in the adjusted trial balance columns. This balance carries across to the work sheet's balance sheet columns.

Income summary, which appears on the work sheet whenever adjusting entries are used to update inventory, is always placed at the bottom of the work sheet's list of accounts. The two adjustments to income summary receive special treatment on the work sheet. Instead of combining the adjustments and placing the result in one of the adjusted trial balance columns, both adjustments are transferred to the adjusted trial balance columns and then to the income statement columns. Income summary's debit entry on the work sheet is used to report the beginning inventory balance on the income statement, and income summary's credit entry is used to report the ending inventory balance on the income statement. Each of these amounts is needed to calculate cost of goods sold.

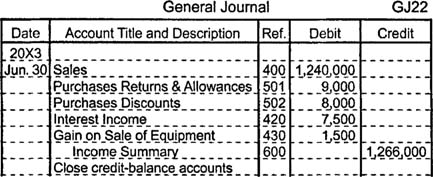

Although merchandising and service companies use the same four closing entries, merchandising companies usually have more temporary accounts to close. The additional accounts include sales, sales returns and allowances, sales discounts, purchases, purchases returns and allowances, purchases discounts, and freight‐in. Consider Music World's four closing entries.

-

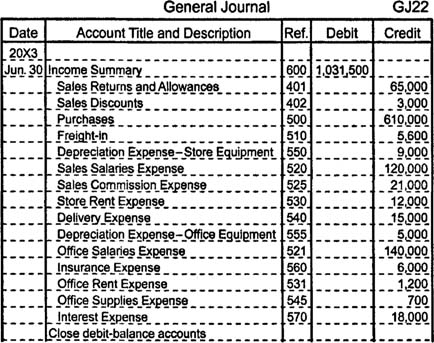

Close all income statement accounts with credit balances to the income summary account. The entry shown below assumes the inventory account was updated with adjusting entries and, therefore, does not include it.

Accountants who choose to update the inventory account during the closing process instead of with adjusting entries include the ending inventory balance with this first closing entry.

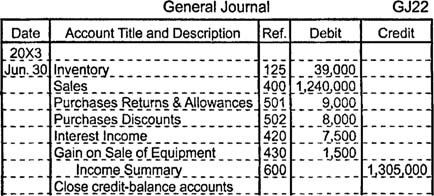

-

Close all income statement accounts with debit balances to the income summary account. The entry shown below assumes the inventory account was updated with adjusting entries and, therefore, does not include it.

If the inventory account is updated during the closing entry process, this closing entry includes a credit equal to the beginning inventory balance ($37,000), which increases the debit to income summary by a corresponding amount (to $1,068,500).

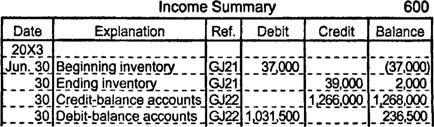

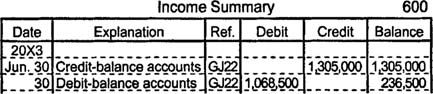

At this point, income summary has the same balance whether adjusting or closing entries are used to update inventory. If adjusting entries are used, four separate entries contribute to the income summary account's balance.

If closing entries are used to update inventory, the first two closing entries establish the income summary account's balance.

The income summary account now has a balance equal to the company's net income or net loss.

-

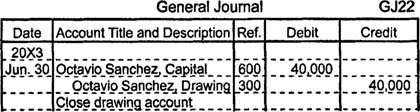

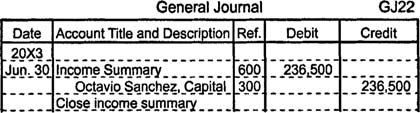

Close income summary to the owner's capital account.

-

Close the owner's drawing account to the owner's capital account. Assume the owner's drawing account has a $40,000 balance.