Sales Returns and Allowances

Although sales returns and sales allowances are technically two distinct types of transactions, they are generally recorded in the same account. Sales returns occur when customers return defective, damaged, or otherwise undesirable products to the seller. Sales allowances occur when customers agree to keep such merchandise in return for a reduction in the selling price.

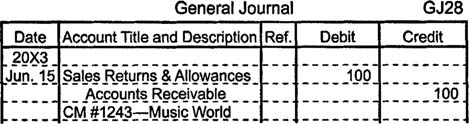

If Music World returns merchandise worth $100, Music Suppliers, Inc., prepares a credit memorandum to account for the return. This credit memorandum becomes the source document for a journal entry that increases (debits) the sales returns and allowances account and decreases (credits) accounts receivable.

A $100 allowance requires the same entry.

In the sales revenue section of an income statement, the sales returns and allowances account is subtracted from sales because these accounts have the opposite effect on net income. Therefore, sales returns and allowances is considered a contra‐revenue account, which normally has a debit balance. Recording sales returns and allowances in a separate contra‐revenue account allows management to monitor returns and allowances as a percentage of overall sales. High return levels may indicate the presence of serious but correctable problems. For example, improved packaging might minimize damage during shipment, new suppliers might reduce the amount of defective merchandise, or better methods for recording and packaging orders might eliminate or reduce incorrect merchandise shipments. The first step in identifying such problems is to carefully monitor sales returns and allowances in a separate, contra‐revenue account.