Discounting Notes Receivable

Just as accounts receivable can be factored, notes can be converted into cash by selling them to a financial institution at a discount. Notes are usually sold (discounted) with recourse, which means the company discounting the note agrees to pay the financial institution if the maker dishonors the note. When notes receivable are sold with recourse, the company has a contingent liability that must be disclosed ni the notes accompanying the financial statements. A contingent liability is an obligation to pay an amount in the future, if and when an uncertain event occurs.

The discount rate is the annual percentage rate that the financial institution charges for buying a note and collecting the debt. The discount period is the length of time between a note's sale and its due date. The discount, which is the fee that the financial institution charges, is found by multiplying the note's maturity value by the discount rate and the discount period.

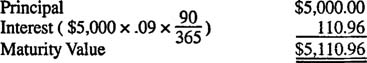

Suppose a company accepts a 90‐day, 9%, $5,000 note, which has a maturity value (principal + interest) of $5,110.96. In this example, precise calculations are made by using a 365‐day year and by rounding results to the nearest penny.

If the company immediately discounts with recourse the note to a bank that offers a 15% discount rate, the bank's discount is $189.04

The bank subtracts the discount from the note's maturity value and pays the company $4,921.92 for the note.

|

Maturity Value

|

$5,110.96

|

|

Discount

|

(189.04)

|

|

Discounted Value of Note

|

$4,921.92

|

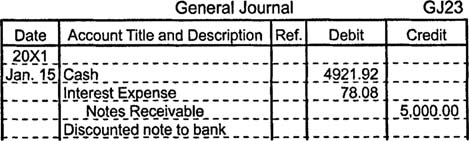

The company determines the interest expense associated with this transaction by subtracting the discounted value of the note from the note's face value plus any interest revenue the company has earned from the note. Since the company discounts the note before earning any interest revenue, interest expense is $78.08 ($5000.00 ‐ $4,921.92). The company records this transaction by debiting cash for $4,921.92, debiting interest expense for $78.08, and crediting notes receivable for $5,000.00.

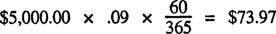

Suppose the company holds the note for 60 days before discounting it. After 60 days, the company has earned interest revenue of $73.97.

Since the note's due date is 30 days away, the bank's discount is $63.01. The bank subtracts the discount from the note's maturity value and pays the company $5,047.95 for the note.

|

Maturity Value

|

$5,110.96

|

|

Discount

|

(63.01)

|

|

Discounted Value of Note

|

$5,047.95

|

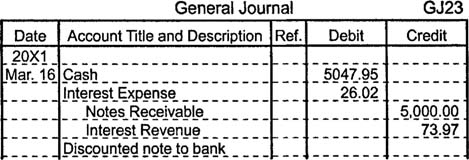

The company subtracts the discounted value of the note from the note's face value plus the interest revenue the company has earned from the note to determine the interest expense, if any, associated with discounting the note. In this example, the interest expense equals $26.02.

|

Note's Face Value + Interest Revenue Earned

|

$5,073.97

|

|

Discounted Value of Note

|

(5,047.95)

|

|

Interest Expense

|

$ 26.02

|

The company records this transaction by debiting cash for $5,047.95, debiting interest expense for $26.02, crediting notes receivable for $5,000.00, and crediting interest revenue for $73.97.