Accountants must make correcting entries when they find errors. There are two ways to make correcting entries: reverse the incorrect entry and then use a second journal entry to record the transaction correctly, or make a single journal entry that, when combined with the original but incorrect entry, fixes the error.

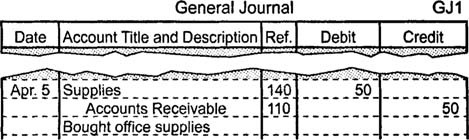

After making a credit purchase for supplies worth $50 on April 5, suppose Mr. Green accidently credits accounts receivable instead of accounts payable.

Mr. Green discovers the error on May 2, after receiving a bill for the supplies. He may use two entries to fix the error: one that reverses the incorrect entry by debiting accounts receivable for $50 and crediting supplies for $50, and another that records the transaction correctly by debiting supplies for $50 and crediting accounts payable for $50.

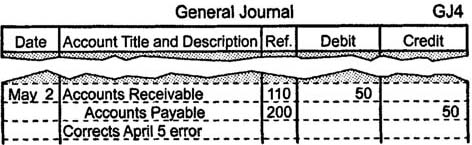

Or Mr. Green can fix the error with a single entry that debits accounts receivable for $50 and credits accounts payable for $50.