The Valuation of Merchandise

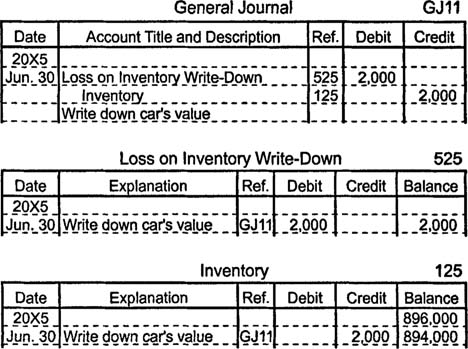

To ensure the proper matching of expenses and revenues, decreases in the value of inventory due to usage, damage, deterioration, obsolescence, and other factors must be recognized in the accounting period during which the decrease occurs rather than the period during which the merchandise sells. Inventory should never be valued at more than its net realizable value, which equals its expected sales price minus any associated selling expenses. For example, if a storm damages a car that cost an automobile dealer $25,000, and if the car can now be sold for no more than $23,000. Then the value of the car must be reported at $23,000. This decrease in the value of inventory is recognized by debiting the loss on inventory write‐down account, which is an expense account, and by crediting inventory.

Some companies attribute inventory write‐downs directly to the cost of goods sold, and some companies use other expense accounts for this purpose, so write‐downs are not usually identified separately on financial statements.

Market value generally equals the replacement cost of inventory. Items sometimes decrease in value because they become less expensive to purchase. In other words, the market value drops. The lower‐of‐cost‐or‐market (LCM) rule is used to determine the value of merchandise inventory.

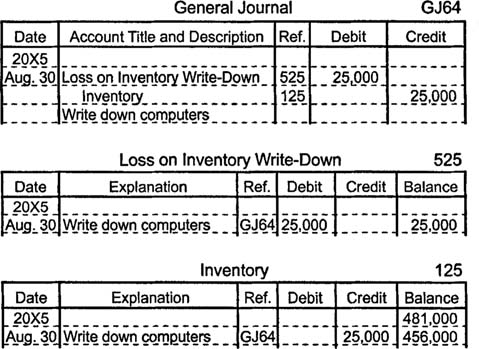

Suppose a retail computer store purchases one hundred computers for $3,000 each. After the store sells fifty of them, the manufacturer decreases the computer's price, enabling the store‐as well as the store's competitors‐to purchase the same type of computer for $2,500. Applying the lower‐of‐cost‐or‐market rule means the value of the fifty remaining computers equals $125,000 (50 × $2,500) rather than $150,000 (50 × $3,000). This $25,000 write‐down is recorded by debiting the loss on inventory write‐down account and by crediting inventory.

Again, many companies choose to record write‐downs using a different expense account than the one shown above.

The LCM rule may be applied to individual inventory items, to groups of similar items, or if the inventory consists of related items, to the entire inventory. As the chart below indicates, applying the LCM rule to individual items produces the most conservative valuation of inventory. As the number of items grouped together increases, the reported value of inventory tends to increase because increases in the market value of some items may partially offset decreases in the market value of other items in the same group.

|

|

|

LCM Rule applied to

|

|

Cost

|

Market

|

Items

|

Groups

|

Entire Inventory

|

|

Computers

|

|

|

|

|

|

|

Model EX7

|

$150,000

|

$125,000

|

$125,000

|

|

|

|

Model NX8

|

30,000

|

32,000

|

30,000

|

|

|

|

Model VX9

|

50,000

|

55,000

|

50,000

|

|

|

|

Total

|

230,000

|

212,000

|

|

$212,000

|

|

|

Printers

|

|

|

|

|

|

|

Model PL30

|

30,000

|

34,000

|

30,000

|

|

|

|

Model PL60

|

15,000

|

18,000

|

15,000

|

|

|

|

Model PL90

|

25,000

|

24,000

|

24,000

|

|

|

|

Total

|

70,000

|

76,000

|

|

70,000

|

|

|

Total inventory

|

$300,000

|

$288,000

|

$274,000

|

$282,000

|

$288,000

|

After the value of inventory has been written down, an increase in net realizable value or market value is not recorded. Instead, such increases are recognized as revenue when sales actually occur. Because companies must estimate net realizable value and because applying the LCM rule to individual items or groups of items yields different inventory values, financial statements should disclose the company's basis for determining the value of inventory.