Evaluating Accounts Receivable

Business owners know that some customers who receive credit will never pay their account balances. These uncollectible accounts are also called bad debts. Companies use two methods to account for bad debts: the direct write‐off method and the allowance method.

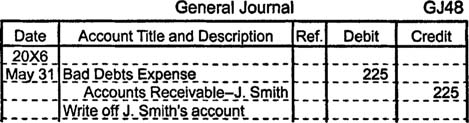

Direct write‐off method. For tax purposes, companies must use the direct write‐off method, under which bad debts are recognized only after the company is certain the debt will not be paid. Before determining that an account balance is uncollectible, a company generally makes several attempts to collect the debt from the customer. Recognizing the bad debt requires a journal entry that increases a bad debts expense account and decreases accounts receivable. If a customer named J. Smith fails to pay a $225 balance, for example, the company records the write‐off by debiting bad debts expense and crediting accounts receivable from J. Smith.

The Internal Revenue Service permits companies to take a tax deduction for bad debts only after specific uncollectible accounts have been identified. Unless a company's uncollectible accounts represent an insignificant percentage of their sales, however, they may not use the direct write‐off method for financial reporting purposes. Since several months may pass between the time that a sale occurs and the time that a company realizes that a customer's account is uncollectible, the matching principle, which requires that revenues and related expenses be matched in the same accounting period, would often be violated if the direct write‐off method were used. Therefore, most companies use the direct write‐off method on their tax returns but use the allowance method on financial statements.

Allowance method. Under the allowance method, an adjustment is made at the end of each accounting period to estimate bad debts based on the business activity from that accounting period. Established companies rely on past experience to estimate unrealized bad debts, but new companies must rely on published industry averages until they have sufficient experience to make their own estimates.

The adjusting entry to estimate the expected value of bad debts does not reduce accounts receivable directly. Accounts receivable is a control account that must have the same balance as the combined balance of every individual account in the accounts receivable subsidiary ledger. Since the specific customer accounts that will become uncollectible are not yet known when the adjusting entry is made, a contra‐asset account named allowance for bad debts, which is sometimes called allowance for doubtful accounts, is subtracted from accounts receivable to show the net realizable value of accounts receivable on the balance sheet.

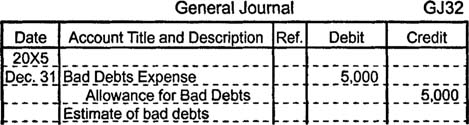

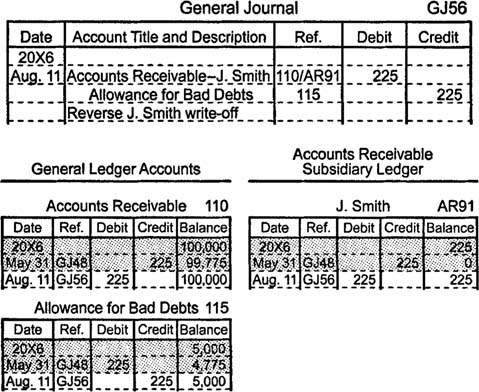

If at the end of its first accounting period a company estimates that $5,000 in accounts receivable will become uncollectible, the necessary adjusting entry debits bad debts expense for $5,000 and credits allowance for bad debts for $5,000.

After the entry shown above is made, the accounts receivable subsidiary ledger still shows the full amount each customer owes, the balance of the control account (accounts receivable) agrees with the total balance in the subsidiary ledger, the credit balance in the contra asset account (allowance for bad debts) can be subtracted from the debit balance in accounts receivable to show the net realizable value of accounts receivable, and a reasonable estimate of bad debts expense is recognized in the appropriate accounting period.

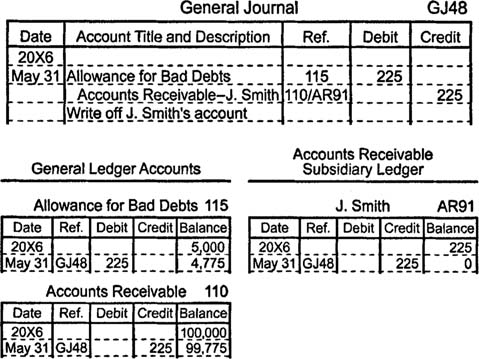

When a specific customer's account is identified as uncollectible, it is written off against the balance in the allowance for bad debts account. For example, J. Smith's uncollectible balance of $225 is removed from the books by debiting allowance for bad debts and crediting accounts receivable. Remember, general journal entries that affect a control account must be posted to both the control account and the specific account in the subsidiary ledger.

Under the allowance method, a write‐off does not change the net realizable value of accounts receivable. It simply reduces accounts receivable and allowance for bad debts by equivalent amounts.

|

Before writing off J. Smith's account

|

After writing off J. Smith's account

|

|

Accounts Receivable

|

$100,000

|

$99,775

|

|

Less: Allowance for Bad Debts

|

(5.000)

|

(4.775)

|

|

Net Realizable Value

|

$95,000

|

$95,000

|

|

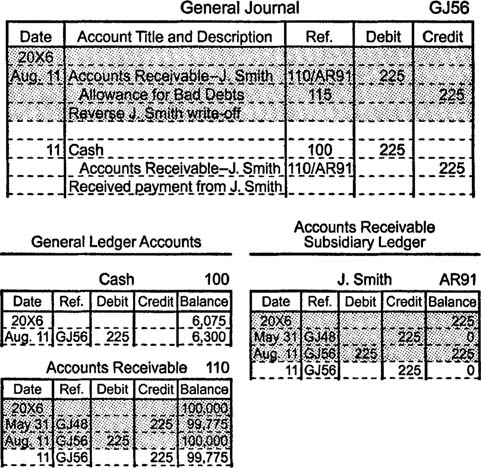

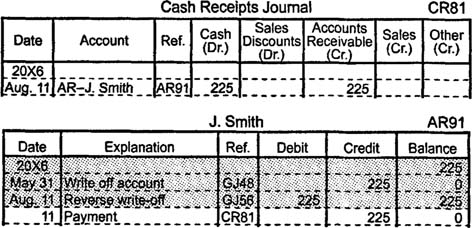

Customers whose accounts have already been written off as uncollectible will sometimes pay their debts. When this happens, two entries are needed to correct the company's accounting records and show that the customer paid the outstanding balance. The first entry reinstates the customer's accounts receivable balance by debiting accounts receivable and crediting allowance for bad debts. As in the previous example, the debit to accounts receivable must be posted to the general ledger control account and to the appropriate subsidiary ledger account.

The second entry records the customer's payment by debiting cash and crediting accounts receivable. Most companies record cash receipts in a cash receipts journal. Since a special journal's column totals are posted to the general ledger at the end of each accounting period, the posting to J. Smith's account is the only one shown with the cash receipts journal entry in the illustration below.

In the future when management looks at J. Smith's payment history, the account's activity will show the eventual collection of the amount owed.

If you use the general journal for the entry shown in the immediately previous cash receipts journal, you post the entry directly to cash and accounts receivable in the general ledger and also to J. Smith's account in the accounts receivable subsidiary ledger.