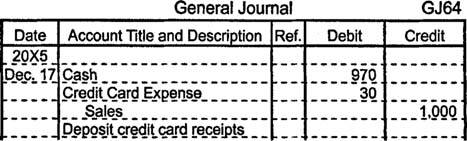

Retail companies, which sell merchandise in small quantities directly to consumers, often receive a significant portion of their revenue through credit card sales. Some credit card receipts, specifically those involving credit cards issued by banks, are deposited along with cash and checks made payable to the company. The company receives cash for these credit card sales immediately. Because banks that issue credit cards to customers handle billing, collections, and related expenses, they usually charge companies between 2% and 5% of the sales price. This fee is deducted when the receipts are deposited in the company's bank account, so these credit card receipts are slightly more complicated to record than other types of cash deposits. If a company deposits credit card receipts totaling $1,000 and the fee is 3%, the company makes a compound entry that debits cash for $970, debits credit card expense for $30 (3% of $1,000), and credits sales for $1,000.

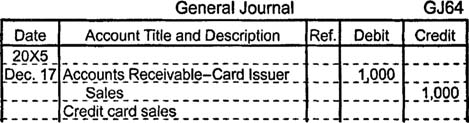

Some credit card receipts must be treated as receivables rather than cash. For example, many gas stations and department stores provide customers with credit cards that can be used to buy goods or services only at the issuer's place of business. When a customer makes a purchase, the company must debit the customer's account and credit the sales account. There are also some major credit cards that are not issued by banks, and receipts from these cards must be sent to the credit card company for reimbursement rather than deposited at a bank. After submitting credit card receipts totaling $1,000 directly to a credit card company, the company that makes the sale records the entry by debiting accounts receivable and crediting sales.

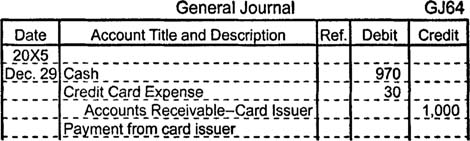

The credit card company deducts their fee before paying the company that made the sale. Upon receiving payment, the company that made the sale debits cash, debits credit card expense, and credits accounts receivable.

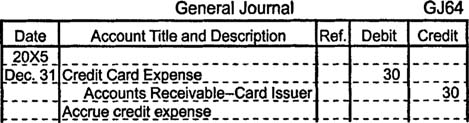

Recording credit card expenses after receiving payment, as in the example above, is convenient because a compound journal entry is all that is needed. However, if the sale occurs during one accounting period and the payment is not received until the next accounting period, an adjusting entry must be made, if the amount of credit card expense is significant, to prevent the matching principle from being violated. The matching principle requires that expenses be recognized during the same accounting period as the revenues they help to generate. If the payment in the previous example had not yet been received at the close of an accounting period, the company would make an adjusting entry that debits credit card expense for $30 and credits accounts receivable for $30.

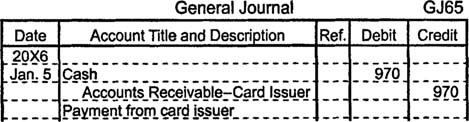

Then, after the payment arrives, cash is debited for $970 and accounts receivable is credited for $970.