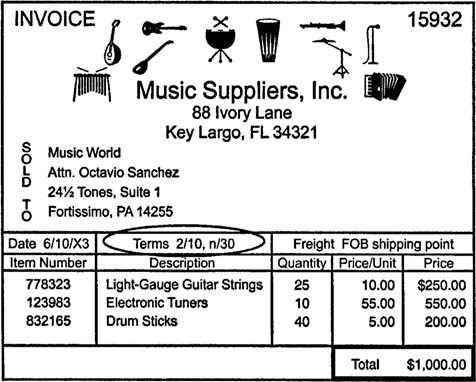

A sales discount is an incentive the seller offers in exchange for prompt payment on credit sales. Sales discounts are recorded in another centra‐revenue account, enabling management to monitor the effectiveness of the company's discount policy. Invoices generally include credit terms, which specify when the customer must pay and define the sales discount if one is available. For example, the credit terms on the invoice below are 2/10, n/30, which is read “two‐ten, net thirty.”

The terms 2/10, n/30 mean the customer may take a two percent discount on the outstanding balance (original invoice amount less any returns and allowances) if payment occurs within ten days of the invoice date. If the customer chooses not to take the discount, the outstanding balance is due within thirty days. An abbreviation that sometimes appears in the credit terms section of an invoice is EOM, which stands for end of month. The terms n/15 EOM indicate that the outstanding balance is due fifteen days after the end of the month in which the invoice is dated.

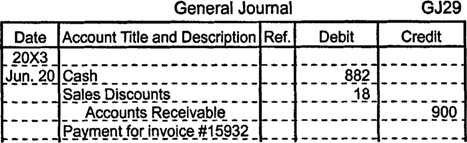

If Music World returns merchandise worth $100 after receiving a $1,000 order, they still owe Music Suppliers, Inc., $900. Assuming the credit terms are 2/10, n/30 and Music World pays the invoice within ten days, the payment equals $882, an amount calculated by subtracting $18 (2% of $900) from the outstanding balance. To record this payment from Music World, Music Suppliers, Inc., makes a compound journal entry that increases (debits) cash for $882, increases (debits) sales discounts for $18, and decreases (credits) accounts receivable for $900.