An adjusting entry to accrue revenues is necessary when revenues have been earned but not yet recorded. Examples of unrecorded revenues may involve interest revenue and completed services or delivered goods that, for any number of reasons, have not been billed to customers. Suppose a customer owes 6% interest on a three‐year, $10,000 note receivable but has not yet made any payments. At the end of each accounting period, the company recognizes the interest revenue that has accrued on this long‐term receivable.

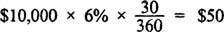

Unless otherwise specified, interest is calculated with the following formula: principal x annual interest rate x time period in years.

Most textbooks use a 360‐day year for interest calculations, which is done here. In practice, however, most lenders make more precise calculations by using a 365‐day year.

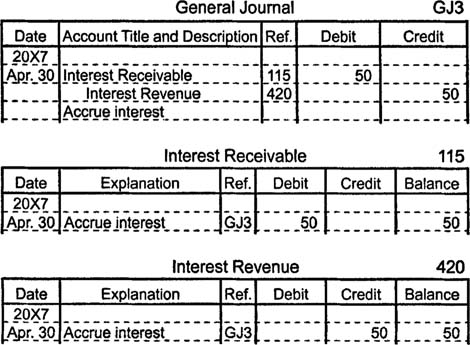

Since the company accrues $50 in interest revenue during the month, an adjusting entry is made to increase (debit) an asset account (interest receivable) by $50 and to increase (credit) a revenue account (interest revenue) by $50.

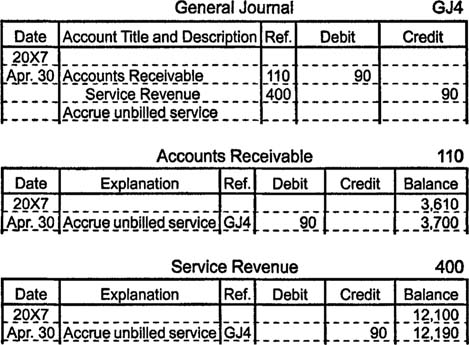

If a plumber does $90 worth of work for a customer on the last day of April but doesn't send a bill until May 4, the revenue should be recognized in April's accounting records. Therefore, the plumber makes an adjusting entry to increase (debit) accounts receivable for $90 and to increase (credit) service revenue for $90.

Accounting records that do not include adjusting entries for accrued revenues understate total assets, total revenues, and net income.