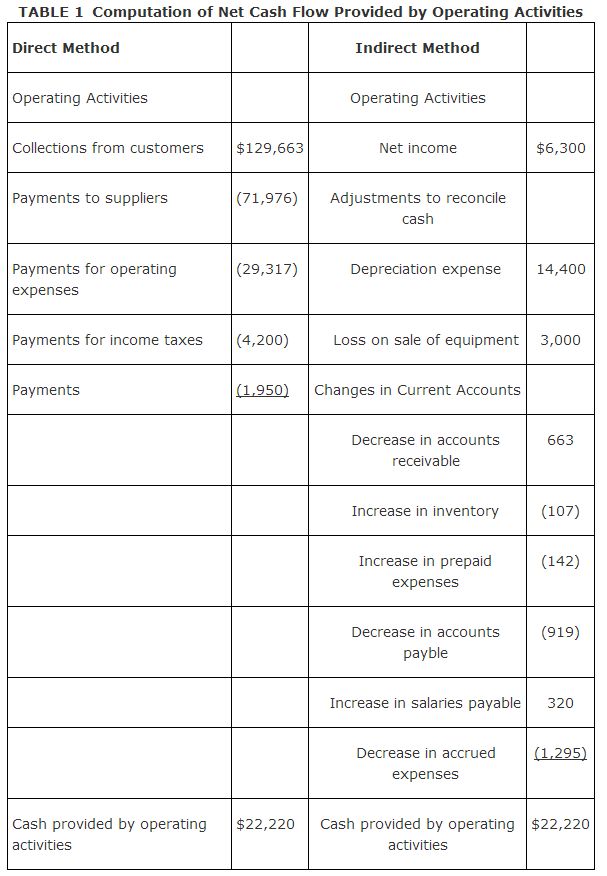

There are two acceptable methods for reporting a statement of cash flows: the direct and the indirect methods. The difference between the two methods is seen in the operating section of the statement of cash flows. Although the total cash provided (used by) operating activities will be the same, the line items used to report the cash flows will be different.

Using the direct method requires cash related to day‐to‐day business operations to be identified by type of activity. For example, cash collected from customers, cash paid to employees, cash paid to suppliers (or paid for merchandise), cash paid for building operations, cash paid for interest, and cash paid for taxes. These types of labels make it easy for the reader to understand where cash came from and what it was spent on.

Although the Financial Accounting Standards Board favors the direct method for preparing the statement of cash flows, most companies do not use the direct method, opting instead for the indirect method because it is easier to prepare and provides less detailed information to competitors. The indirect method begins with the assumption that net income equals cash and adjusts net income for significant non‐cash income statement items such as depreciation, amortization, and gains and losses from sales, and for net changes in current asset, current liability, and income tax accounts. Table shows the operating activities section prepared using each method

.

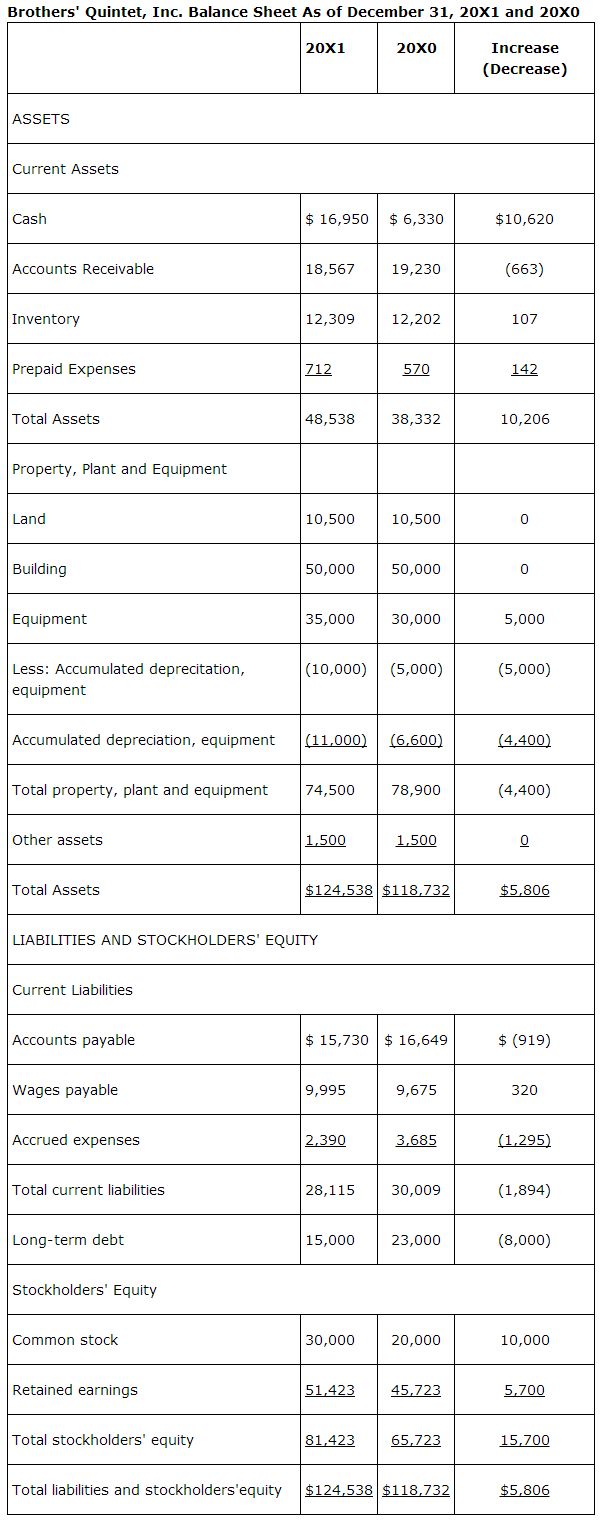

The information in the 20X1 and 20X0 balance sheets and the 20X1 income statement for the Brothers' Quintet, Inc. will be used to illustrate the preparation of the statement of cash flows using the direct and indirect methods. Additional information regarding the Brothers' Quintet, Inc., include:

- All sales are made on credit. The company has no bad debts.

- Accounts payable represents amounts owed suppliers for merchandise. All purchases of merchandise are made on account.

- Equipment with a cost of $15,000 and accumulated depreciation of $5,000 was sold for $7,000.

- 1,000 additional shares of common stock were sold for $10 each.

- Dividends totaling $600 were declared and paid in the current year.

- No amounts are accrued for interest or income taxes.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|