Amounts owed to employees for work performed are recorded separately from accounts payable. Expense accounts such as salaries or wages expense are used to record an employee's gross earnings and a liability account such as salaries payable, wages payable, or accrued wages payable is used to record the net pay obligation to employees. Additional payroll‐related liabilities include amounts owed to third parties for any amounts withheld from the gross earnings of each employee and the payroll taxes owed by the employer. Examples of withholdings from gross earnings include federal, state, and local income taxes and FICA (Federal Insurance Contributions Act: social security and medical) taxes, investments in retirement and savings accounts, health‐care premiums, union dues, uniforms, alimony, child care, loan payments, stock purchase plans offered by employer, and charitable contributions. The employer payroll taxes include social security and medical taxes (same amount as employees), federal unemployment tax, and state unemployment tax.

Net pay and withholding liabilities

Payroll withholdings include required and voluntary deductions authorized by each employee. Withheld amounts represent liabilities, as the company must pay the amounts withheld to the appropriate third party. The amounts do not represent expenses of the employer. The employer is simply acting as an intermediary, collecting money from employees and passing it on to third parties.

Required deductions. These deductions are made for federal income taxes, and when applicable, state and local income taxes. The amounts withheld are based on an employee's earnings and designated withholding allowances. Withholding allowances are usually based on the number of exemptions an employee will claim on his/her income tax return, but may be adjusted based on the employee's estimated income tax liability. The employee is required to complete a W‐4 form authorizing the number of withholdings before the employer can process payroll. The employer withholds income tax amounts based on the allowances designated by each employee and tax tables provided by the government. The employer pays these withheld amounts to the Internal Revenue Service (IRS). In addition to income taxes, FICA requires a deduction from employees' pay for federal social security and Medicare benefits programs. This deduction is usually referred to as FICA taxes. FICA taxes are withheld by the employer and are deposited along with federal income taxes in a financial institution.

Voluntary deductions. These deductions are authorized by employees and may include amounts for purchase of company stock, retirement investments, deposits in a savings account, loan payments, union dues, charitable contributions, health, dental, and life insurance premiums, and alimony.

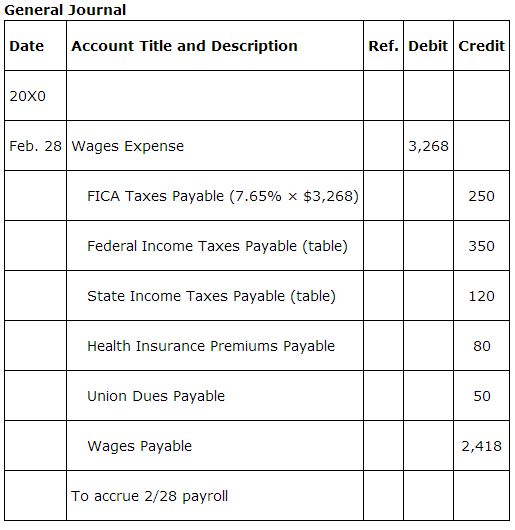

Net pay. Net pay is the employee's gross earnings less mandatory and voluntary deductions. It is the amount the employee receives on payday, so called “take‐home pay.” An entry to record a payroll accrual includes an increase (debit) to wages expense for the gross earnings of employees, increases (credits) to separate accounts for each type of withholding liability, and an increase (credit) to a payroll liability account, such as wages payable, for employees' net pay.

Special journals are used for certain transactions. However, all companies use a general journal.

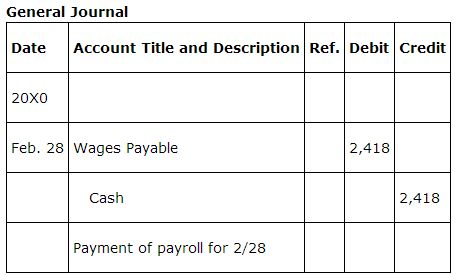

When the employees are paid, an entry is made to reduce (debit) the wages payable account balance and decrease (credit) cash.

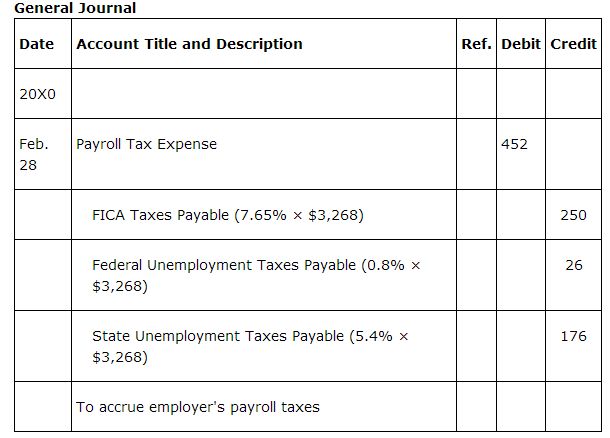

The employer is responsible for three payroll-related taxes:

-

FICA Taxes.

- Federal Unemployment Taxes (FUTA).

- State Unemployment Taxes(SUTA).

The FICA taxes paid by the employers are an amount equal to the FICA taxes paid by the employees. The entry for the employer's payroll taxes expense for the Feb. 28th payroll would include increases (credits) to liabilities for FICA taxes of $250 (the employer has to match the amount paid by employees), FUTA taxes of $26 (0.8% × $3,268), and SUTA taxes of $176 (5.4% × $3,268). The amount of the increase (debit) to payroll tax expense is determined by adding the amounts of the three liabilities.

|

|

|

|

|

|

|

|

|

|

|