In addition to annual and quarterly sales budgets, monthly budgets are often prepared so sales can be tracked against expectations more frequently than once every three months.

Before preparing the direct materials, direct labor, and manufacturing overhead budgets, the production budget must be completed.

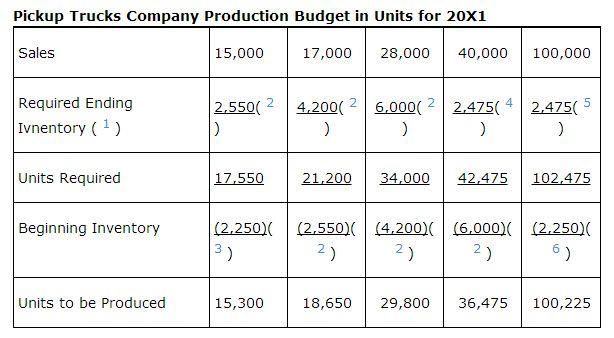

Production budget. The production budget shows the number of units that must be produced. To budget for annual production, three things must be known: the number of units to be sold, the required level of inventory at the end of the year, and the number of units, if any, in the beginning inventory. If quarterly budgets are required, this same information is needed on a quarterly basis. Using the Pickup Trucks Company's quarterly sales budget and given that 15% of the next quarter's sales volume must be on hand before the quarter begins, the production budget by quarter can be prepared. Further assumptions are a 10% increase in sales in quarter one of next year compared to the current year's quarter‐one sales, and 2,250 units in inventory at the beginning of the year.

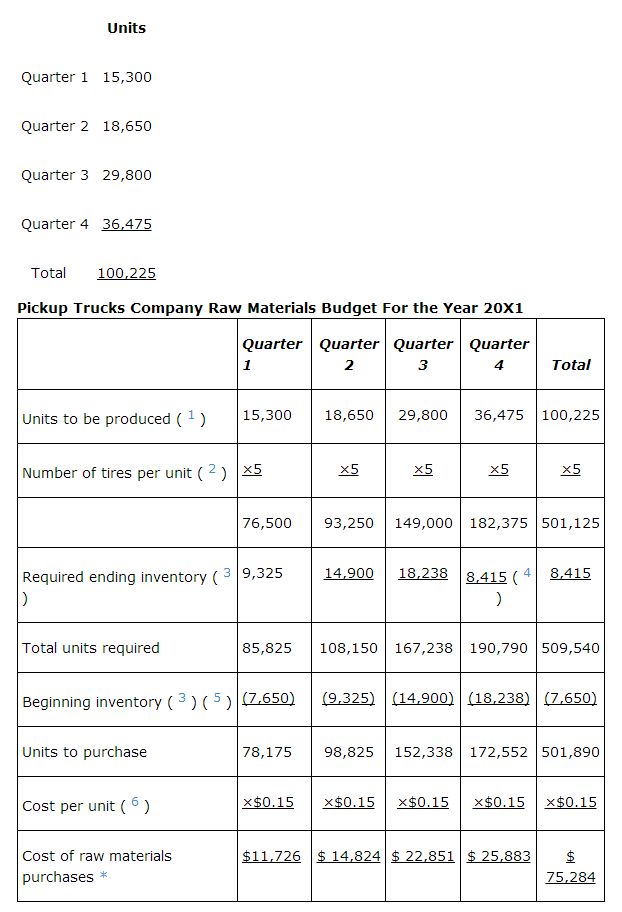

Direct materials budget. The direct materials budget determines the number of units of raw materials to be purchased. It uses the number of units to be produced from the production budget, the required level of ending inventory for raw materials, and the number of units in beginning inventory. Once the number of units to be purchased is determined, it is multiplied by the cost per unit to determine the budgeted amount for raw materials purchases. The Pickup Trucks Company requires 10% of next quarter's production requirement for raw materials to be in its ending inventory. For example, because it takes five tires to make the special toy pickup truck (four plus the spare tire mounted on the side), at a cost of $0.50 per tire, the raw materials purchases budget calculates 501,890 tires required at a cost of $250,945. The units in the production budget are adjusted for units in ending and beginning inventories, multiplied by five (number of tires per pick up) to determine total tires to be purchased and then multiplied by $0.50 to determine the cost of the tires needed. As a reminder, the production budget showed the following units for 20X1:

This process is repeated for all the other raw material components used in producing a toy pickup truck.

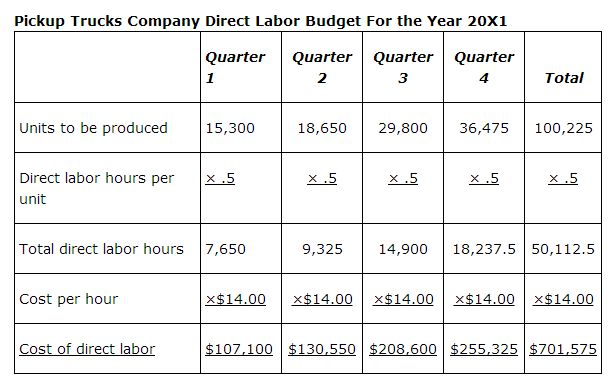

Direct labor budget. The direct labor budget shows the number of direct labor hours and the cost of the labor to determine the total cost of direct labor. Assume it takes one‐half hour of labor to put together one pickup truck and each labor hour costs $14.00. The total direct labor budget is for 50,113 (100,225 units × .5 hours per unit) hours at a cost of $701,575 ($14.00 per hour × 50,113 hours). The break out by quarter is shown in the following table.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|