Activity-Based vs Traditional Costing

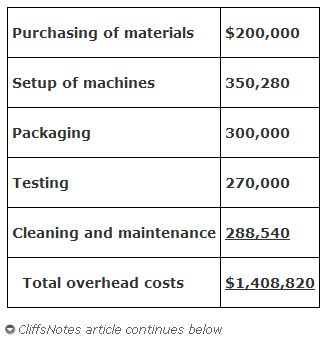

Assume the Busy Ball Company makes two types of bouncing balls; one has a hollow center and the other has a solid center. The same equipment is used to produce the balls in different runs. Between batches, the equipment is cleaned, maintained, and set up in the proper configuration for the next batch. The hollow center balls are packaged with two balls per package, and the solid center balls are packaged one per package. During the year, Busy Ball expects to make 1,000,000 hollow center balls and 2,000,000 solid center balls. The overhead costs incurred have been allocated to activity pools as follows:

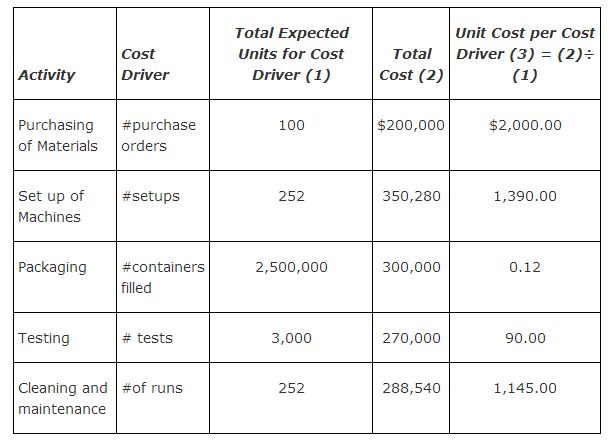

By analyzing the activity pools, the accountants and production managers have identified the cost drivers, estimated the total expected units for each product, and calculated the unit cost for each cost driver.

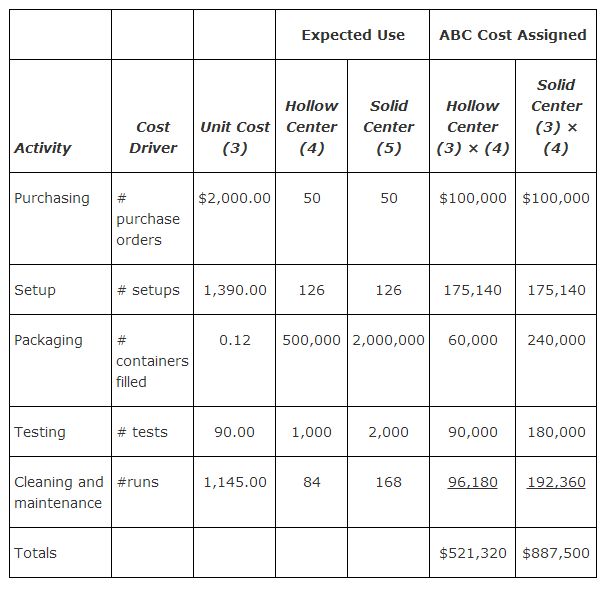

The activity by product is shown in the following table.

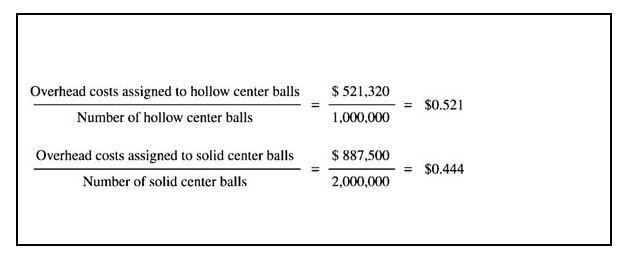

To calculate the per unit overhead costs under ABC, the costs assigned to each product are divided by the number of units produced. In this case, the unit cost for a hollow center ball is $0.52 and the unit cost for a solid center ball is $0.44.

![]()

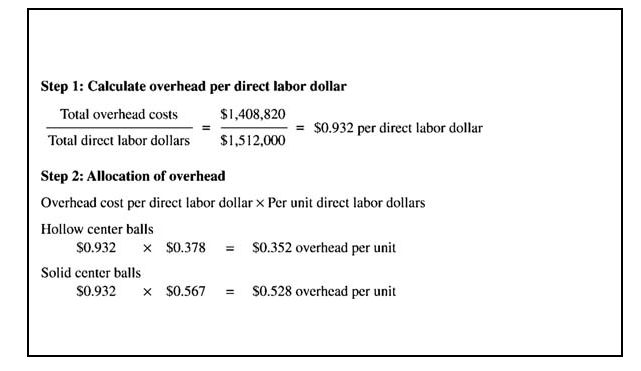

Under the traditional method of allocating overhead based on direct labor dollars, the total costs for all balls would be divided by total direct labor dollars for all balls to determine the per unit cost. Estimated direct labor costs for the year are $1,512,000, of which $378,000 is for hollow center balls and $1,134,000 is for solid center balls. The per unit direct labor costs are $0.38 for hollow center balls ($378,000 ÷ 1,000,000) and $0.57 for solid center balls ($1,134,000 ÷ 2,000,000). The per unit cost to produce balls is calculated in two steps:

- Calculate the predetermined overhead rate by dividing total overhead costs by total direct labor dollars.

- Allocate overhead to each type of product by multiplying the overhead cost per direct labor dollar by the per unit direct labor dollars for hollow center balls and for solid center balls.

![]()

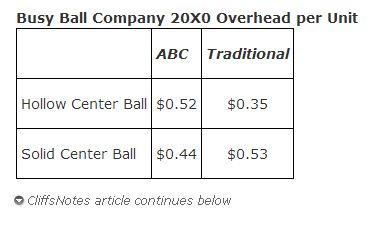

A comparison of the overhead per unit calculated using the ABC and traditional methods often shows very different results:

In this example, the overhead charged to the hollow ball using ABC is $0.52 and much higher than the $0.35 calculated under the traditional method. The $0.52 is a more accurate cost for making decisions about pricing and production. For the solid center ball, the overhead calculated is $0.44 per unit using the ABC method and $0.53 per unit using the traditional method. The reason for the differences is the traditional method determines the cost allocation using direct labor dollars only, so a product with high direct labor dollars gets allocated more of the overhead costs than a product with low direct labor dollars. The number of orders, setups, or tests the product actually uses does not impact the allocation of overhead costs when direct labor dollars are used to allocate overhead.

ABC provides a way to allocate costs more accurately when overhead costs are not incurred at the same rate as direct labor dollars. The more activities identified, the more complex the costing system becomes. Computer systems are needed for complex ABC systems. Some companies limit the number of activities used in the costing system to keep the system manageable. While this approach may result in some allocations being arbitrary, using ABC does provide a more accurate estimate of costs for use in making management decisions.

|

|

|

|

|

|

|

|

|

|

|