Earnings per share

Corporations are also required to report earnings per share on the income statement. Earnings per share represents the amount of earnings related to one share of common stock. There are two types of earnings per share, basic earnings per share and diluted earnings per share. If applicable, both types of earnings per share must be reported. In addition, if the corporation has any of the special items just described, earnings per share must be reported for income from continuing operations, each special item, and net income.

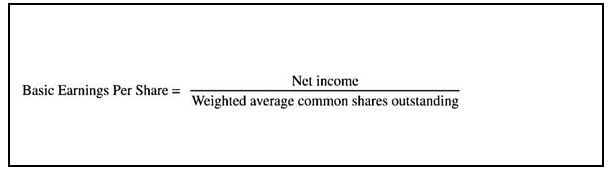

If no preferred stock is outstanding, basic earnings per share is calculated by dividing net income by weighted average number of common shares outstanding for the period.

![]()

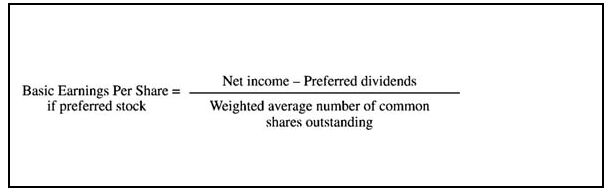

If preferred stock is outstanding, the current year's dividend declared on preferred stock is deducted from net income prior to dividing by weighted average number of common shares outstanding.

![]()

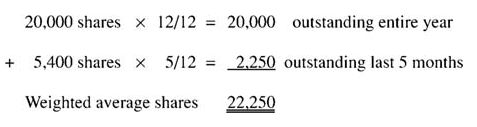

If the number of common shares outstanding changes during the period, the weighted average number of shares is used to calculate earnings per share. The weighting is based on how long shares are outstanding during the period. For example, if Tom & Margaret, Inc. began the year with 20,000 shares outstanding and issued an additional 5,400 shares on August 20, the weighted average shares would be calculated as:

![]()

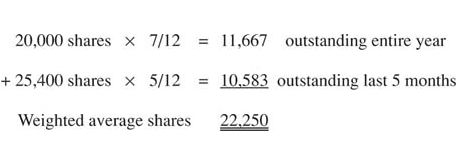

Alternatively, the weighted average shares may be calculated using the total common shares outstanding at a given time.

![]()

Diluted earnings per share

Diluted earnings per share uses the same formula. However, it requires that additional common shares, which could become outstanding as a result of the corporation's compensation plans or having issued convertible debt or convertible preferred stock, to also be included as outstanding common stock. As the formula includes additional shares outstanding, the diluted earnings per share is usually less than basic earnings per share.

Think of earnings per share as a continuum with basic earnings per share on one end and diluted earnings per share on the other.