Accounting by Manufacturing Companies

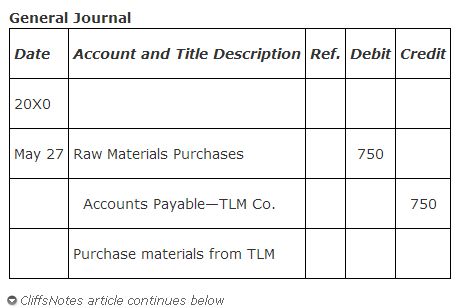

The accounting cycle is the same in a manufacturing company, merchandising company, and a service company. Journal entries are used to record transactions, adjusting journal entries are used to recognize costs and revenues in the appropriate period, financial statements are prepared, and closing entries are recorded. Raw material purchases are recorded in the raw material inventory account if the perpetual inventory method is used, or the raw materials purchases account if the periodic inventory method is used. For example, using the periodic inventory method, the purchase of $750 of raw materials on account is recorded as an increase (debit) to raw materials purchases and an increase (credit) to accounts payable.

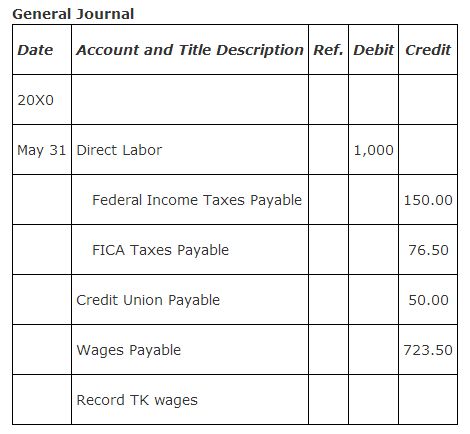

The entry to record payroll would include an increase (debit) to direct labor instead of wages expense and an increase (credit) to the withholding liability account and wages payable. To record $1,000 wages for T. Kaschalk, the entry would be:

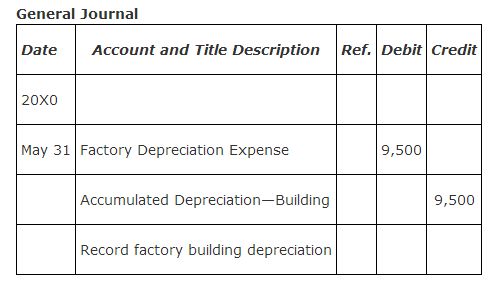

The factory building depreciation of $9,500 is classified as a manufacturing cost. It is recorded with an increase (debit) to factory depreciation and an increase (credit) to accumulated depreciation—building.

Some companies use one account, factory overhead, to record all costs classified as factory overhead. If one overhead account is used, factory overhead would be debited in the previous entry instead of factory depreciation.

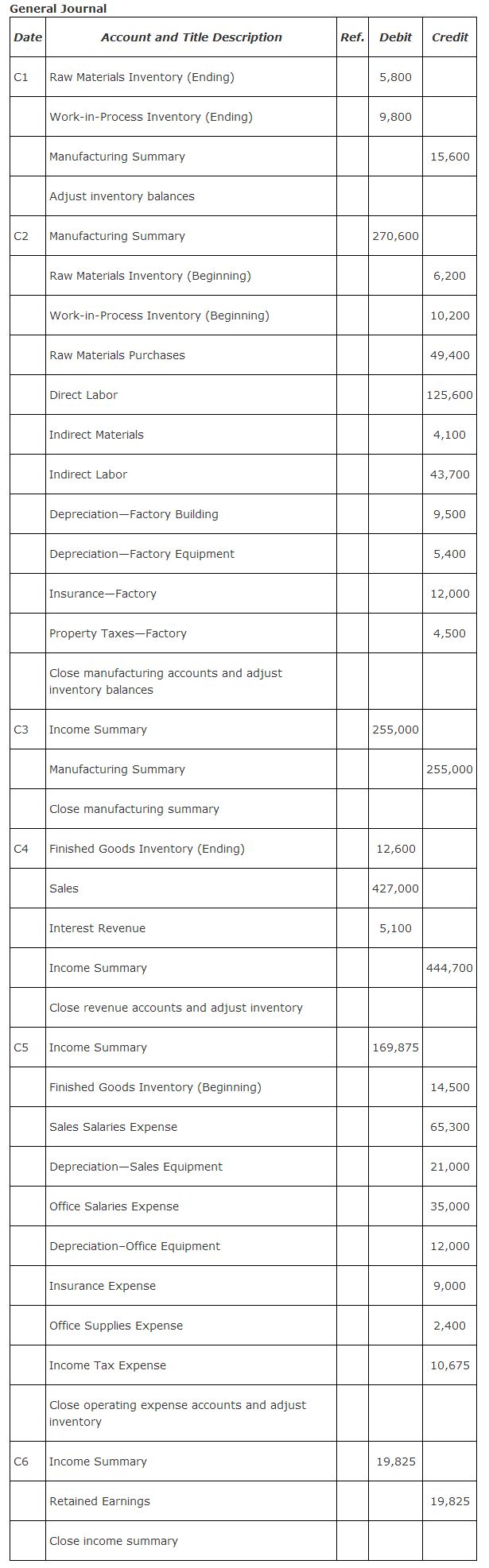

At the end of the cycle, the closing entries are prepared. For a manufacturing company that uses the periodic inventory method, closing entries update retained earnings for net income or loss and adjust each inventory account to its period end balance. A special account called manufacturing summary is used to close all the accounts whose amounts are used to calculate cost of goods manufactured. The manufacturing summary account is closed to income summary. Income summary is eventually closed to retained earnings. The manufacturing accounts are closed first. The closing entries that follow are based on the accounts included in the cost of goods manufactured schedule and income statement for Red Car, Inc.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|