Activity-Based Costing Activities

Traditionally, in a job order cost system and process cost system, overhead is allocated to a job or function based on direct labor hours, machine hours, or direct labor dollars. However, in some companies, new technologies have changed the manufacturing environment such that the number of hours worked or dollars earned by employees are no longer good indicators of how much overhead will be needed to complete a job or process products through a particular function. In such companies, activity‐based costing (ABC) is used to allocate overhead costs to jobs or functions.

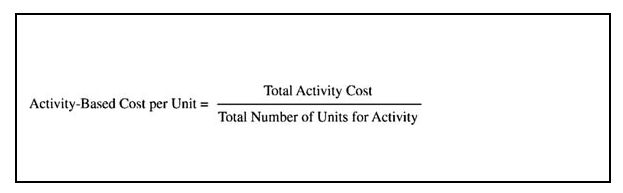

Activity‐based costing assumes that the steps or activities that must be followed to manufacture a product are what determine the overhead costs incurred. Each overhead cost, whether variable or fixed, is assigned to a category of costs. These cost categories are called activity cost pools. Cost drivers are the actual activities that cause the total cost in an activity cost pool to increase. The number of times materials are ordered, the number of production lines in a factory, and the number of shipments made to customers are all examples of activities that impact the costs a company incurs. When using ABC, the total cost of each activity pool is divided by the total number of units of the activity to determine the cost per unit.

![]()

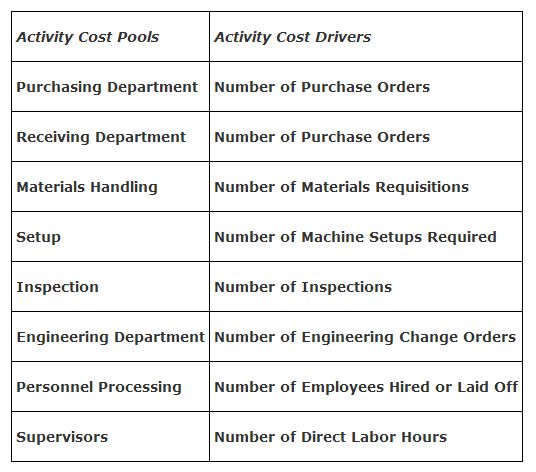

The number of activities a company has may be small, say five or six, or number in the hundreds. Computers make using ABC easier. Assume Lady Trekkers, Inc., has identified its activity cost pools and cost drivers (see the following table).

A per unit cost is calculated by dividing the total dollars in each activity cost pool by the number of units of the activity cost drivers. As an example to calculate the per unit cost for the purchasing department, the total costs of the purchasing department are divided by the number of purchase orders. Lady Trekkers, Inc., has determined that both the purchasing and receiving departments' costs are based on the number of purchase orders; therefore, the two departments' costs may be added together so that one per unit cost is calculated for these departments. Once the per unit costs are all calculated, they are added together, and the total cost per unit is multiplied by the number of units to assign the overhead costs to the units.

Activity categories

While using cost drivers to assign overhead costs to individual units works well for some activities, for some activities such as setup costs, the costs are not incurred to produce an individual unit but rather to produce a batch of the same units. For other costs, the costs incurred might be based on the number of product lines or simply because there is a manufacturing facility. To assign overhead costs more accurately, activity‐based costing assigns activities to one of four categories:

- Unit‐level activities occur every time a service is performed or a product is made. The costs of direct materials, direct labor, and machine maintenance are examples of unit‐level activities.

- Batch‐level activities are costs incurred every time a group (batch) of units is produced or a series of steps is performed. Purchase orders, machine setup, and quality tests are examples of batch‐level activities.

- Product‐line activities are those activities that support an entire product line but not necessarily each individual unit. Examples of product‐line activities are engineering changes made in the assembly line, product design changes, and warehousing and storage costs for each product line.

- Facility support activities are necessary for development and production to take place. These costs are administrative in nature and include building depreciation, property taxes, plant security, insurance, accounting, outside landscape and maintenance, and plant management's and support staff's salaries.

The costs of unit‐level, batch‐level, and product‐line activities are easily allocated to a specific product, either directly as a unit‐level activity or through allocation of a pooled cost for batch‐level and product‐line activities. In contrast, the facility‐level costs are kept separate from product costs and are not allocated to individual units because the allocation would have to be made on an arbitrary basis such as square feet, number of divisions or products, and so on.

|

|

|

|

|

|

|