Accounting for Equity Securities

An equity security is an investment in stock issued by another company. The accounting for an investment in an equity security is determined by the amount of control of and influence over operating decisions the company purchasing the stock has over the company issuing the stock. If less than 20% of the stock is acquired and no significant influence or control exists, the investment is accounted for using the cost method. If 20–50% of the stock is owned, the investor is usually able to significantly influence the company it has invested in. Assuming the investor does not control the number of positions on the Board of Directors or hold key officer positions, this investment would be accounted for using the equity method. If the investor has 50% or more of a company's stock, significant influence and control are deemed to exist and the investor reports its results using consolidated financial statements. Although percent of voting stock owned serves as a guideline, the amount of influence and control is used to determine the accounting for equity securities.

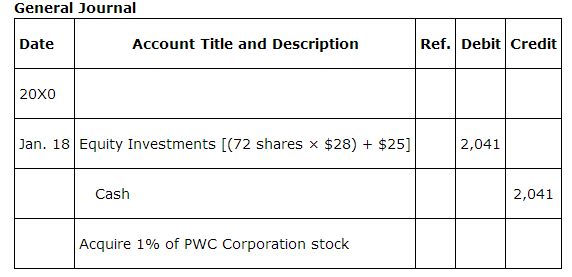

The cost method of accounting for stock investments records the acquisition costs in an asset account, “Equity Investments.” As with debt investments, acquisition costs include commissions and fees paid to acquire the stock. If 72 shares of PWC Corporation are acquired when the market price is $28 and a $25 broker's fee is paid, the entry to record the purchase is:

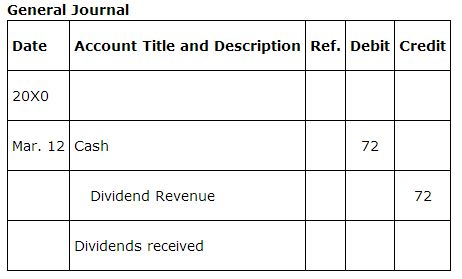

As dividends are received, dividend income is recorded. If PWC Corporation pays a $1 per share cash dividend, the entry to record the receipt of the dividend increases (debits) cash and increases (credits) dividend revenue.

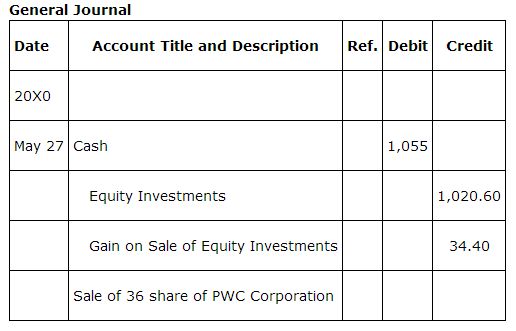

Equity investments accounted for by using the cost method are classified as either trading securities or available‐for‐sale securities, and the value of the investment is adjusted to market value. When an equity investment accounted for under the cost method is sold, a gain or loss is recognized for the difference between its acquisition cost and the proceeds received from the sale. Assume 36 of the PWC Corporation shares purchased were sold for $30 per share and a fee of $25 was paid. The entry to record the sale would increase (debit) cash for the proceeds received of $1,055 (36 × $30 = $1,080 – $25 fee), decrease (credit) equity investments by $1,020.60 ($2,041 ÷ 72 = $28.35 × 36 shares) and record a gain on the sale for the $34.40 difference.

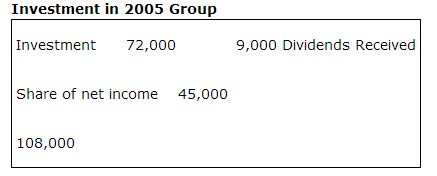

The equity method of accounting for stock investments is used when the investor is able to significantly influence the operating and financial policies or decisions of the company it has invested in. Given this influence, the investor adjusts the value of its equity investment for dividends received from, and the earnings (or losses) of, the corporation whose stock has been purchased. The dividends received are accounted for as a reduction of the investment value because dividends are a partial return of the investor's investment. Assume The Sisters, Inc. acquired 30% of the stock of 2005 GROUP for $72,000 on Jan. 1. During the year, 2005 GROUP paid dividends totaling $30,000 and had net income of $150,000. Under the equity method, the $9,000 in dividends ($30,000 × 30%) received by The Sisters, Inc. would decrease the Investment in 2005 GROUP account rather than be reported as dividend revenue. The same account would increase $45,000 for The Sisters, Inc. 30% share of net income ($150,000 × 30%) as they treat their share of net income as revenue. At the end of the year, the balance in the Investment in 2005 GROUP account would be $108,000.

The entries by The Sisters, Inc. to record the acquisition of 2005 GROUP stock, receipt of dividends, and share of net income are:

Consolidated financial statements

A company that owns greater than 50% of another entity is called the parent company. The company whose stock is owned is called the subsidiary company. A parent company uses the equity method to account for its investment in its subsidiary. When financial statements are prepared, the assets and liabilities (balance sheet), revenues and expenses (income statement), and cash flows (cash flow statement) of both the parent company and subsidiary company are combined and shown in the same statements. These statements are called consolidated balance sheets, consolidated income statements, and consolidated cash flow statements—together they are called consolidated financial statements—and represent the financial position, results of operations, and cash flows of the parent company and any other companies it controls.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|