Understanding Notes Payable

A liability is created when a company signs a note for the purpose of borrowing money or extending its payment period credit. A note may be signed for an overdue invoice when the company needs to extend its payment, when the company borrows cash, or in exchange for an asset. An extension of the normal credit period for paying amounts owed often requires that a company sign a note, resulting in a transfer of the liability from accounts payable to notes payable. Notes payable are classified as current liabilities when the amounts are due within one year of the balance sheet date. When the debt is long‐term (payable after one year) but requires a payment within the twelve‐month period following the balance sheet date, the amount of the payment is classified as a current liability in the balance sheet. The portion of the debt to be paid after one year is classified as a long‐term liability.

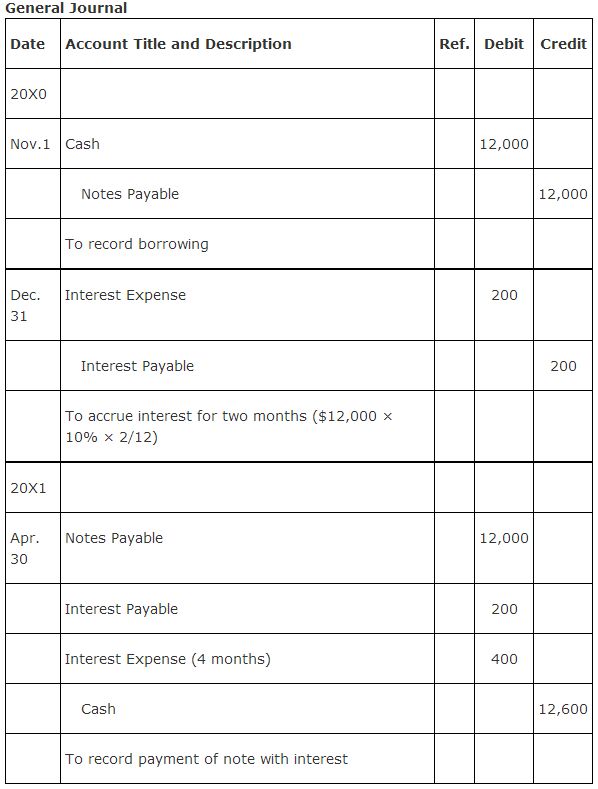

Notes payable almost always require interest payments. The interest owed for the period the debt has been outstanding that has not been paid must be accrued. Accruing interest creates an expense and a liability. A different liability account is used for interest payable so it can be separately identified. The entries for a six‐month, $12,000 note, signed November 1 by The Quality Control Corp., with interest at 10% are:

If The Quality Control Corp. signs a note for $12,000 including interest, it is called a noninterest‐bearing note because the $12,000 represents the total amount due at maturity and not the amount of cash received by The Quality Control Corp. Interest must be calculated (imputed) using an estimate of the interest rate at which the company could have borrowed and the present value tables. The present value of the note on the day of signing represents the amount of cash received by the borrower. The total interest expense (cost of borrowing) is the difference between the present value of the note and the maturity value of the note. In order to follow the matching principle, the total interest expense is initially recorded as “Discount on Notes Payable.” Over the term of the note, the discount balance is charged to (amortized) interest expense such that at maturity of the note, the balance in the discount account is zero. Discount on notes payable is a contra account used to value the Notes Payable shown in the balance sheet.

Unearned revenues

Unearned revenues represent amounts paid in advance by the customer for an exchange of goods or services. Examples of unearned revenues are deposits, subscriptions for magazines or newspapers paid in advance, airline tickets paid in advance of flying, and season tickets to sporting and entertainment events. As the cash is received, the cash account is increased (debited) and unearned revenue, a liability account, is increased (credited). As the seller of the product or service earns the revenue by providing the goods or services, the unearned revenues account is decreased (debited) and revenues are increased (credited). Unearned revenues are classified as current or long‐term liabilities based on when the product or service is expected to be delivered to the customer.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

A contingent liability represents a potential future liability based on actions already taken by a company. Lawsuits, product warranties, debt guarantees, and IRS disputes are examples of contingent liabilities. The guidelines to follow in determining whether a contingent liability must be recorded as a liability or just disclosed in financial statements are as follows:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Record a liability if the contingency is likely to occur, or is probable and can be reasonably estimated (for example, product warranty costs).

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Disclose in notes to financial statements if the contingency is reasonably possible (for example, legal suits, debt guarantees, and IRS disputes that may require a cash settlement or otherwise impact financial statements).

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Do nothing if the contingency is unlikely to occur, or remote (for example, legal suits, debt guarantees, and IRS disputes the company believes it will win).

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

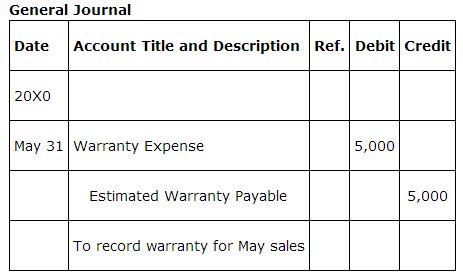

Warranty liabilities

A warranty represents an obligation of the selling company to repair or replace defective products for a certain period of time. This obligation meets the probable and reasonably estimated criteria of a contingent liability because a company's prior history of making warranty repairs identifies warranty work as probable, and current warranty costs can be reasonably estimated based on past work and current warranties. This obligation creates an expense that is matched against the revenues in the current period's income statement (matching principle) and an estimated liability. The liability is estimated because although the company knows it will have to do warranty work, they do not know the exact cost of that work. If Oxy Co. sells 10,000 units, expecting 1% to be returned under warranty and an average cost of $50 to repair each unit, the estimated liability of $5,000 (10,000 × $50) is recorded as follows:

When warranty work is performed, the estimated warranty payable is decreased.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|