The long‐term financing used to purchase property is called a mortgage. The property itself serves as collateral for the mortgage until it is paid off. A mortgage usually requires equal payments, consisting of principal and interest, throughout its term. The early payments consist of more interest than principal. Over the life of the mortgage, the portion of each payment that represents principal increases and the interest portion decreases. This decrease occurs because interest is calculated on the outstanding principal balance that declines as payments are made.

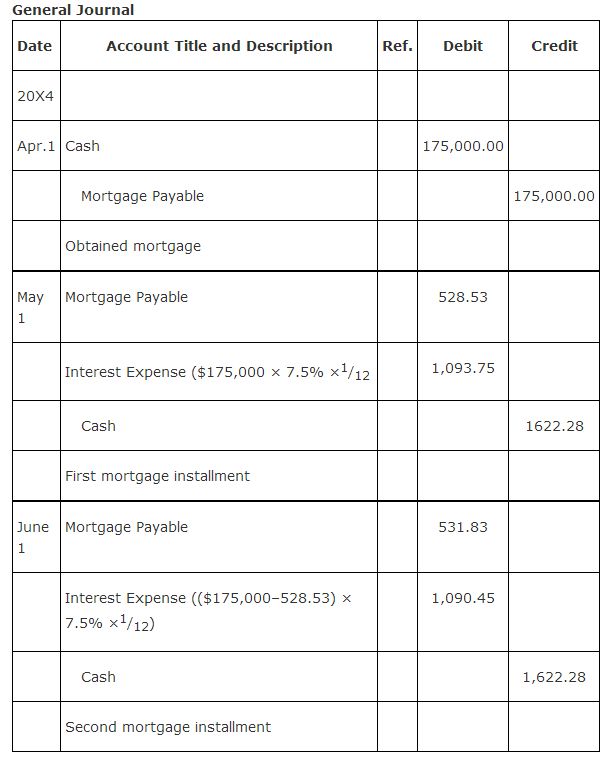

The Stats Man obtains a fifteen‐year $175,000 mortgage with a 7.5% interest rate and a monthly payment of $1,622.28. The borrowing and receipt of cash is recorded with an increase (debit) to cash and an increase (credit) to mortgage payable. When a payment is made, mortgage payable is decreased (debited) for the principal portion of the payment, interest expense is increased (debited) for the interest portion of the payment, and cash is decreased (credited) by the payment amount of $1,622.28. The interest portion of the first payment is $1,093.75, which is calculated by multiplying the $175,000 principal balance times the 7.5% interest rate times 1/ 12 because payments are made monthly. The interest portion of the second payment is $1,090.45. It is different from the first payment because after the first payment, the outstanding principal balance was reduced by $528.53, the difference between the payment amount of $1,622.28 and the $1,093.75 interest expense. The $1,090.45 was calculated by multiplying the $174,471.47 principal balance times 7.5% times 1/ 12. This process of calculating the interest portion of each payment continues until the mortgage is paid off. The principal portion of each payment is the difference between the cash paid and the interest expense calculated. The entries to record the receipt of the mortgage and the first two installment payments are: