One source of financing available to corporations is long‐term bonds. Bonds represent an obligation to repay a principal amount at a future date and pay interest, usually on a semi‐annual basis. Unlike notes payable, which normally represent an amount owed to one lender, a large number of bonds are normally issued at the same time to different lenders. These lenders, also known as investors, may sell their bonds to another investor prior to their maturity.

There are many different types of bonds available to interested investors. Some of the more common forms are:

- Serial bonds. Bonds issued in groups that mature at different dates. For example, $5,000,000 of serial bonds, $500,000 of which mature each year from 5–14 years after they are issued.

-

Sinking fund bonds. Bonds that require the issuer to set aside a pool of assets used only to repay the bonds at maturity. These bonds reduce the risk that the company will not have enough cash to repay the bonds at maturity.

-

Convertible bonds. Bonds that can be exchanged for a fixed number of shares of the company's common stock. In most cases, it is the investor's decision to convert the bonds to stock, although certain types of convertible bonds allow the issuing company to determine if and when bonds are converted.

-

Registered bonds. Bonds issued in the name of a specific owner. This is how most bonds are issued today. Having a registered bond allows the owner to automatically receive the interest payments when they are made.

- Bearer bonds. Bonds that require the bondholder, also called the bearer, to go to a bank or broker with the bond or coupons attached to the bond to receive the interest and principal payments. They are called bearer or coupon bonds because the person presenting the bond or coupon receives the interest and principal payments.

-

Secured bonds. Bonds are secured when specific company assets are pledged to serve as collateral for the bondholders. If the company fails to make payments according to the bond terms, the owners of secured bonds may require the assets to be sold to generate cash for the payments.

-

Debenture bonds. These unsecured bonds require the bondholders to rely on the good name and financial stability of the issuing company for repayment of principal and interest amounts. These bonds are usually riskier than secured bonds. A subordinated debenture bond means the bond is repaid after other unsecured debt, as noted in the bond agreement.

The price of a bond is based on the market's assessment of any risk associated with the company that issues (sells) the bonds. The higher the risk associated with the company, the higher the interest rate. Bonds issued with a coupon interest rate (also called contract rate or stated rate) higher than the market interest rate are said to be offered at a premium. The premium is necessary to compensate the bond purchaser for the above average risk being assumed. Bonds are issued at a discount when the coupon interest rate is below the market interest rate. Bonds sold at a discount result in a company receiving less cash than the face value of the bonds.

Bonds are denominated in $1,000s. A market price of 100 means the bond sold for 100% of face value. If its face value is $1,000, the sales price was $1,000. A bond sold at 102, a premium, would generate $1,020 cash for the issuing company (102% × $1,000) while one sold at 97, a discount, would provide $970 cash for the issuing company (97% × $1,000).

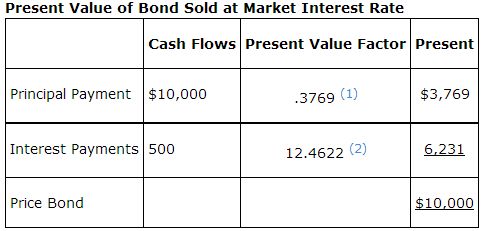

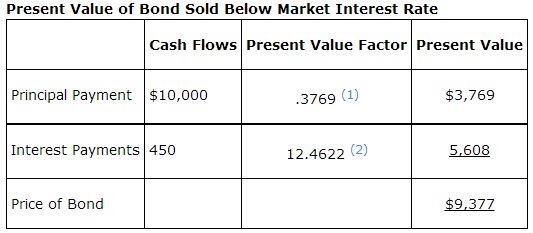

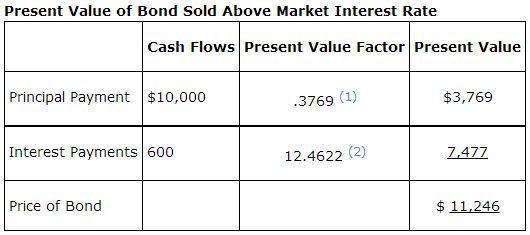

To illustrate how bond pricing works, assume Lighting Process, Inc. issued $10,000 of ten‐year bonds with a coupon interest rate of 10% and semi‐annual interest payments when the market interest rate is 10%. This means Lighting Process, Inc. will repay the principal amount of $10,000 at maturity in ten years and will pay $500 interest ($10,000 × 10% coupon interest rate × 6/ 12) every six months. The price of the bonds is based on the present value of these future cash flows. The principal and interest amounts are based on the face amounts of the bond while the present value factors used to calculate the value of the bond at issuance are based on the market interest rate of 10%. Given these facts, the purchaser would be willing to pay $10,000, or the face value of the bond, as both the coupon interest rate and the market interest rate were the same. The total cash paid to investors over the life of the bonds is $20,000, $10,000 of principal at maturity and $10,000 ($500 × 20 periods) in interest throughout the life of the bonds.

Assume instead that Lighting Process, Inc. issued bonds with a coupon rate of 9% when the market rate was 10%. The bond purchaser would be willing to pay only $9,377 because Lighting Process, Inc. will pay $450 in interest every six months ($10,000 × 9% × 6/ 12), which is lower than the market rate of interest of $500 every six months. The total cash paid to investors over the life of the bonds is $19,000, $10,000 of principal at maturity and $9,000 ($450 × 20 periods) in interest throughout the life of the bonds.

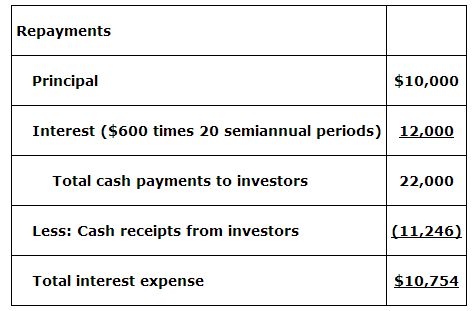

If instead, Lighting Process, Inc. issued its $10,000 bonds with a coupon rate of 12% when the market rate was 10%, the purchasers would be willing to pay $11,246. Semi‐annual interest payments of $600 are calculated using the coupon interest rate of 12% ($10,000 × 12% × 6/ 12). The total cash paid to investors over the life of the bonds is $22,000, $10,000 of principal at maturity and $12,000 ($600 × 20 periods) in interest throughout the life of the bonds. Lighting Process, Inc. receives a premium (more cash than the principal amount) from the purchasers. The purchasers are willing to pay more for the bonds because the purchasers will receive interest payments of $600 when the market interest payment on the bonds was only $500.

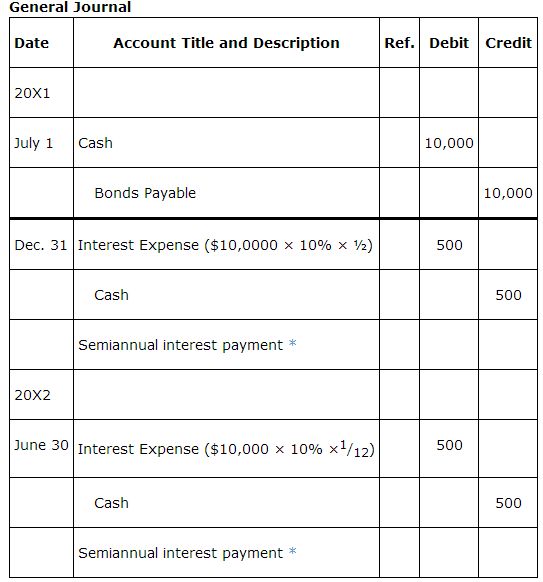

The journal entries made by Lighting Process, Inc. to record its issuance at par of $10,000 ten‐year bonds with a coupon rate of 10% and the semiannual interest payments made on June 30 and December 31 are as shown.

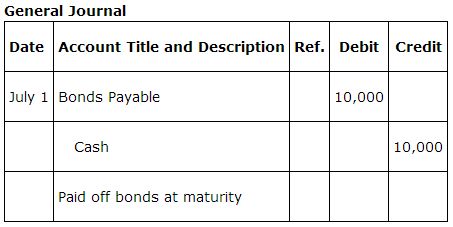

The bonds are classified as long‐term liabilities when they are issued. When the bond matures, the principal repayment is recorded as follows:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

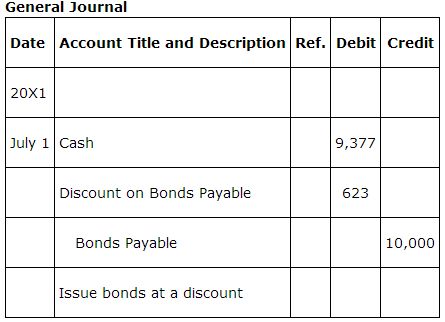

Lighting Process, Inc. issues $10,000 ten‐year bonds, with a coupon interest rate of 9% and semiannual interest payments payable on June 30 and Dec. 31, issued on July 1 when the market interest rate is 10%. The entry to record the issuance of the bonds increases (debits) cash for the $9,377 received, increases (debits) discount on bonds payable for $623, and increases (credits) bonds payable for the $10,000 maturity amount. Discount on bonds payable is a contra account to bonds payable that decreases the value of the bonds and is subtracted from the bonds payable in the long‐term liability section of the balance sheet. Initially it is the difference between the cash received and the maturity value of the bond.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

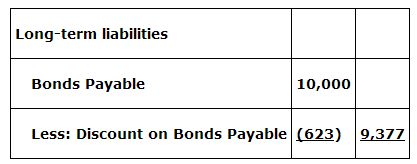

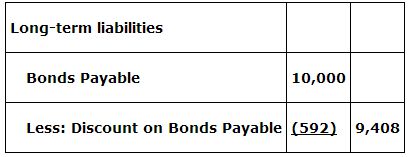

After this entry, the bond would be included in the long‐term liability section of the balance sheet as follows:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

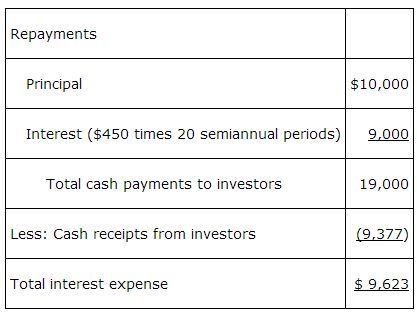

The $9,377 is called the carrying amount of the bond. The discount on bonds payable is the difference between the cash received and the maturity value of the bonds and represents additional interest expense to Lighting Process, Inc. (the company that issued the bond). The total interest expense can be calculated using the bond‐related payments and receipts as shown:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

The interest expense is amortized over the twenty periods during which interest is paid. Amortization of the discount may be done using the straight‐line or the effective interest method. Currently, generally accepted accounting principles require use of the effective interest method of amortization unless the results under the two methods are not significantly different. If the amounts of interest expense are similar under the two methods, the straight‐line method may be used.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

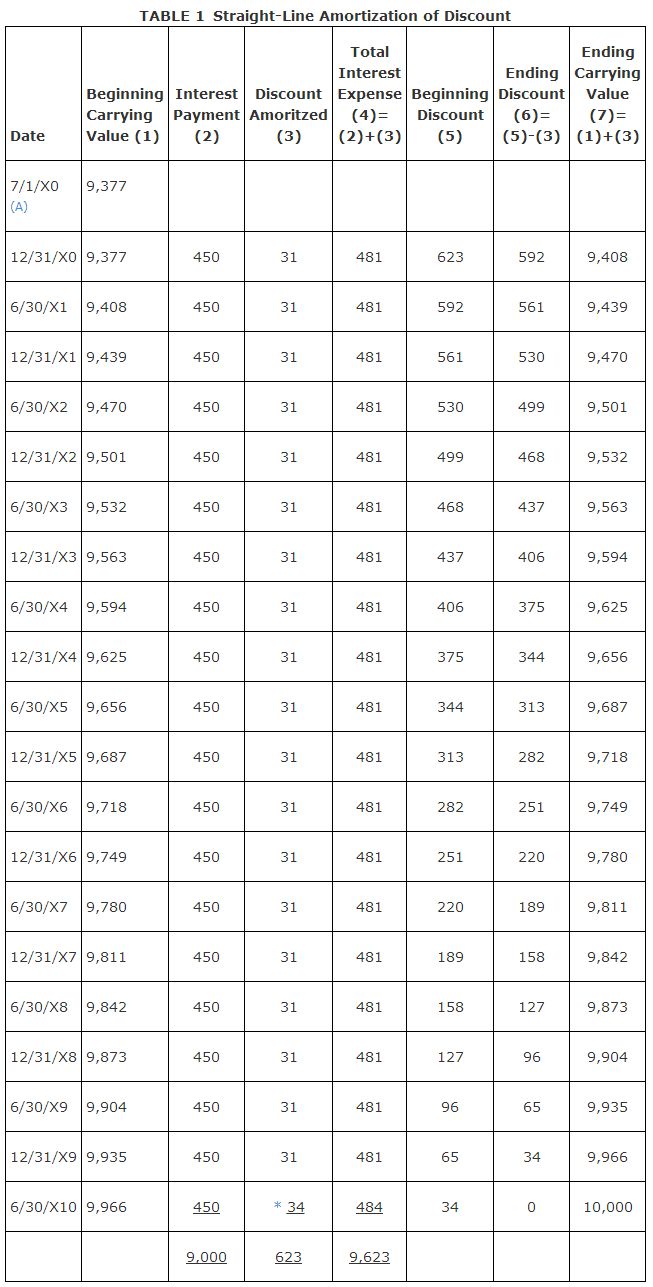

The straight‐line method of allocating the discount to interest expense (also called amortization of the discount) spreads the $623 of discount evenly over the 20 semiannual interest payments made for the bonds. To calculate the additional interest expense to be recognized when recording the semiannual interest payments, divide the total discount by the number of interest payments. In this example, an additional $31.15 ($623 ÷ 20) of interest expense would be recognized every six months. This has been rounded to $31 for illustration purposes. The amount of discount amortized ($31) is added to the interest paid ($450) to determine the total interest expense recorded. The entry to pay interest on December 31, 20X1 would be:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

After the payment is recorded, the carrying value of the bonds payable on the balance sheet increases to $9,408 because the discount has decreased to $592 ($623–$31).

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

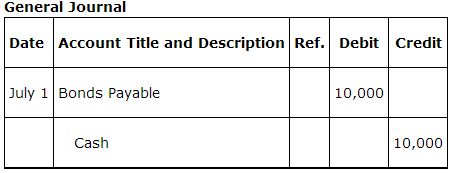

The carrying value will continue to increase as the discount balance decreases with amortization. When the bond matures, the discount will be zero and the bond's carrying value will be the same as its principal amount. The discount amortized for the last payment may be slightly different based on rounding. See Table 1 for interest expense calculated using the straight‐line method of amortization and carrying value calculations over the life of the bond. At maturity, the entry to record the principal payment is shown in the General Journal entry that follows Table 1.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

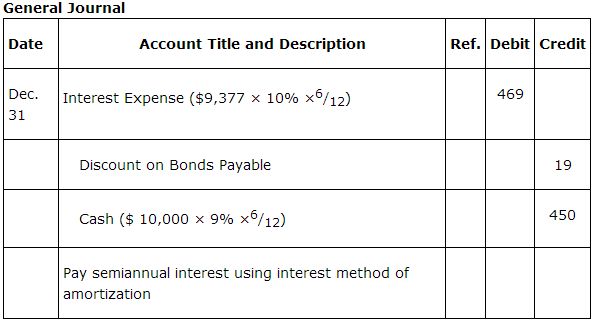

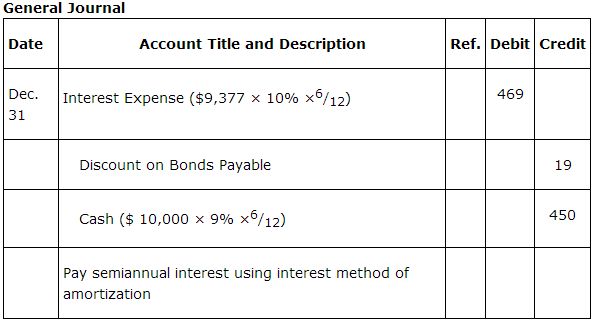

The effective interest method of amortizing the discount to interest expense calculates the interest expense using the carrying value of the bonds and the market rate of interest at the time the bonds were issued. For the first interest payment, the interest expense is $469 ($9,377 carrying value × 10% market interest rate × 6/ 12 semiannual interest). The semiannual interest paid to bondholders on Dec. 31 is $450 ($10,000 maturity amount of bond × 9% coupon interest rate × 6/ 12 for semiannual payment). The $19 difference between the $469 interest expense and the $450 cash payment is the amount of the discount amortized. The entry on December 31 to record the interest payment using the effective interest method of amortizing interest is shown on the following page.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

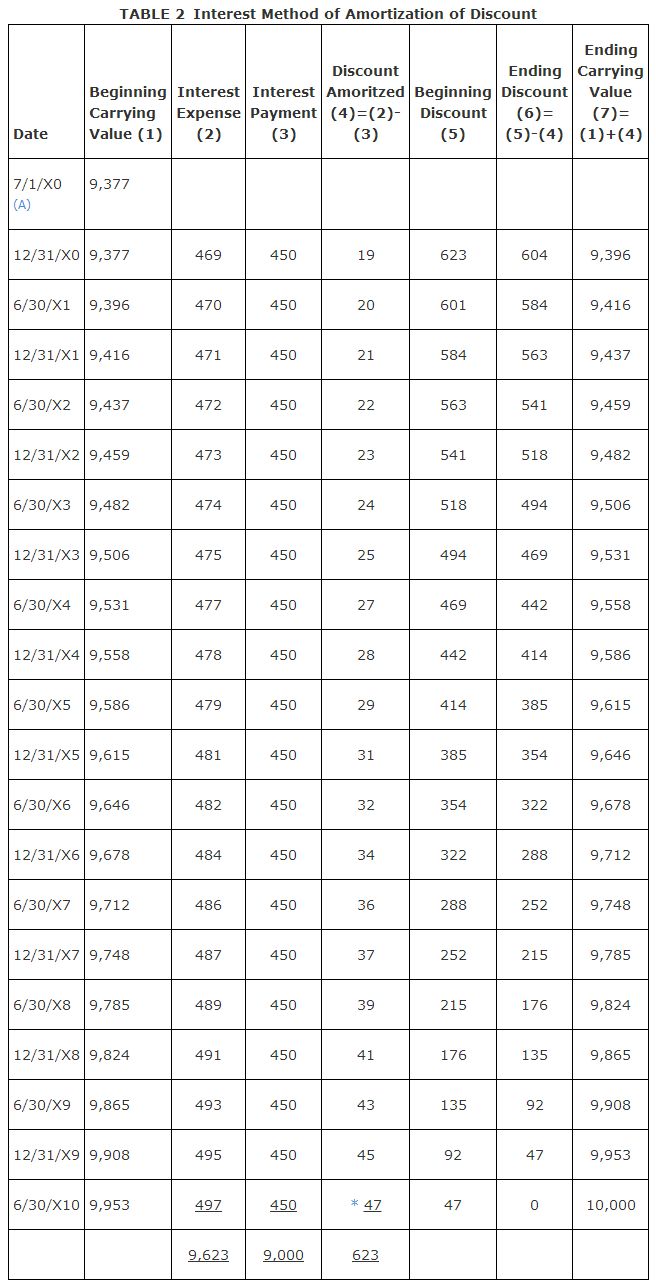

As the discount is amortized, the discount on bonds payable account's balance decreases and the carrying value of the bond increases. The amount of discount amortized for the last payment is equal to the balance in the discount on bonds payable account. As with the straight‐line method of amortization, at the maturity of the bonds, the discount account's balance will be zero and the bond's carrying value will be the same as its principal amount. See Table 2 for interest expense and carrying values over the life of the bond calculated using the effective interest method of amortization

.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

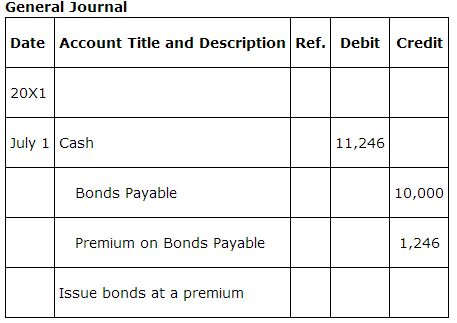

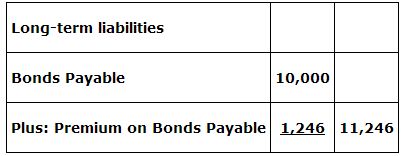

On July 1, Lighting Process, Inc. issues $10,000 ten‐year bonds, with a coupon rate of interest of 12% and semiannual interest payments payable on June 30 and December 31, when the market interest rate is 10%. The entry to record the issuance of the bonds increases (debits) cash for the $11,246 received, increases (credits) bonds payable for the $10,000 maturity amount, and increases (credits) premium on bonds payable for $1,246. Premium on bonds payable is a contra account to bonds payable that increases its value and is added to bonds payable in the long‐term liability section of the balance sheet.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

After the Entry,the bonds would be included in the long-term liability section of the balance sheet as follows:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

The premium account balance represents the difference (excess) between the cash received and the principal amount of the bonds. The premium account balance of $1,246 is amortized against interest expense over the twenty interest periods. Unlike the discount that results in additional interest expense when it is amortized, the amortization of premium decreases interest expense. The total interest expense on these bonds will be $10,754 rather than the $12,000 that will be paid in cash.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

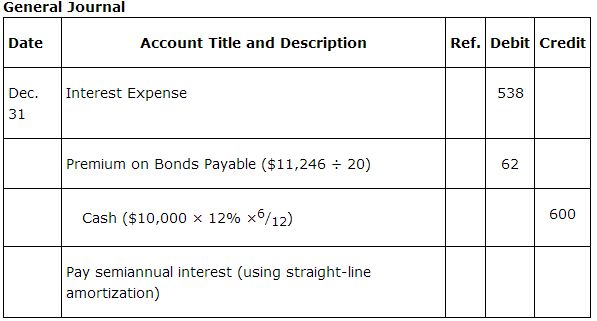

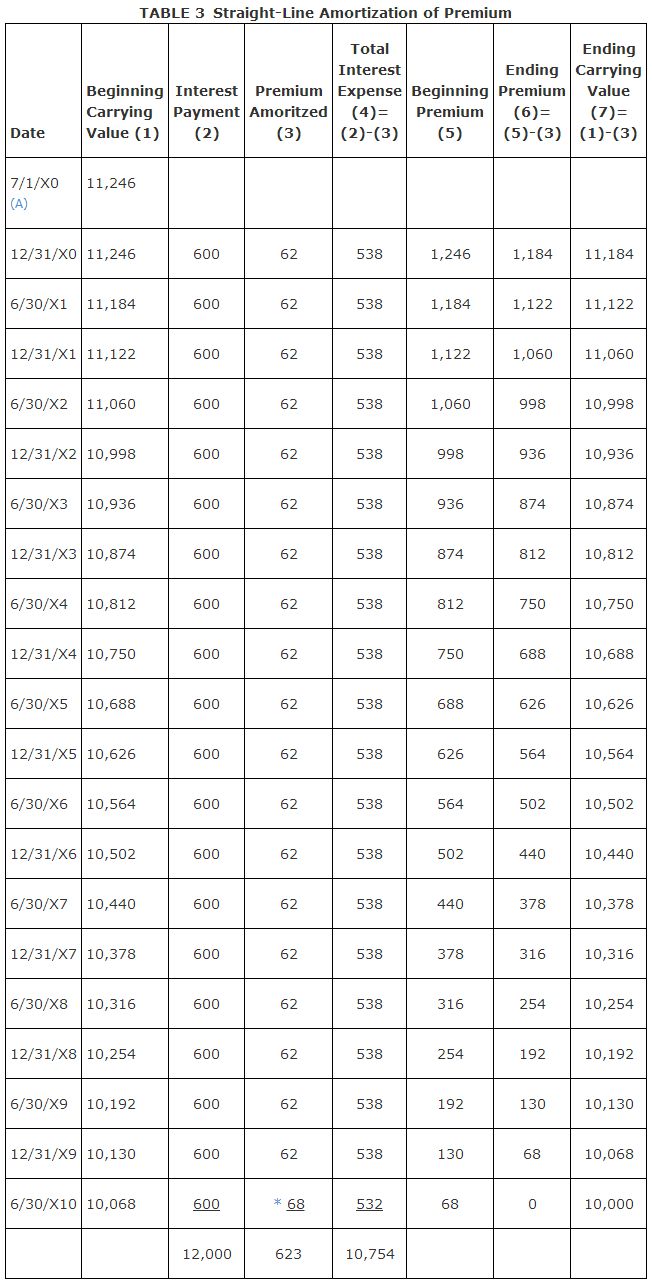

As with discount amortization, the amortization of premium may be done using the straight‐line or effective interest method. The straight‐line method spreads the $1,246 premium account's balance evenly over the 20 semiannual interest payments made for the bonds. This method divides the total premium by the number of interest payments to determine the reduction in interest expense to be recognized semiannually. In this case, interest expense will be reduced by $62.30 ($1,246 ÷ 20), say $62, every six months. The entry for the first interest payment would be as follows:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

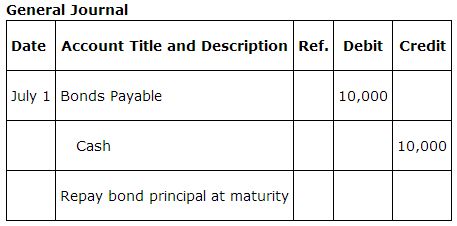

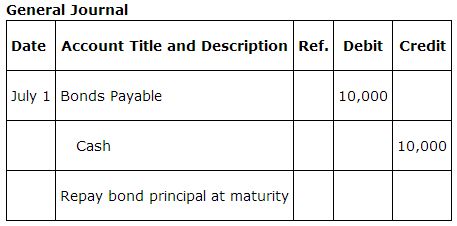

The carrying value will continue to decrease as the premium account's balance decreases. When the bond matures, the premium account's balance will be zero and the bond's carrying value will be the same as the bond's principal amount. The premium amortized for the last payment should be the balance in the premium on bonds payable account. At maturity, the entry to record the principal repayment is:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

See Table 3 for interest expense and carrying value calculations over the life of the bond using the straight‐line method of amortization

.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

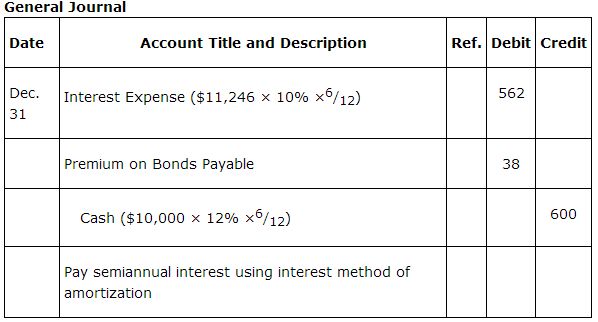

The effective interest method of amortizing the premium calculates interest expense using the carrying value of the bonds and the market interest rate when the bonds were issued. For the first payment, the interest expense is $562. It is calculated by multiplying the $11,246 (carrying value of the bonds) times 10% (market interest rate) × / (semiannual payment). The amount of interest paid is $600 ($10,000 face value of bonds × 12% coupon interest rate × / semiannual payments). The $38 of premium amortization is the difference between the interest expense and the interest paid. The entry to record the first interest payment on December 31 using the effective interest method of amortizing the premium would be:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

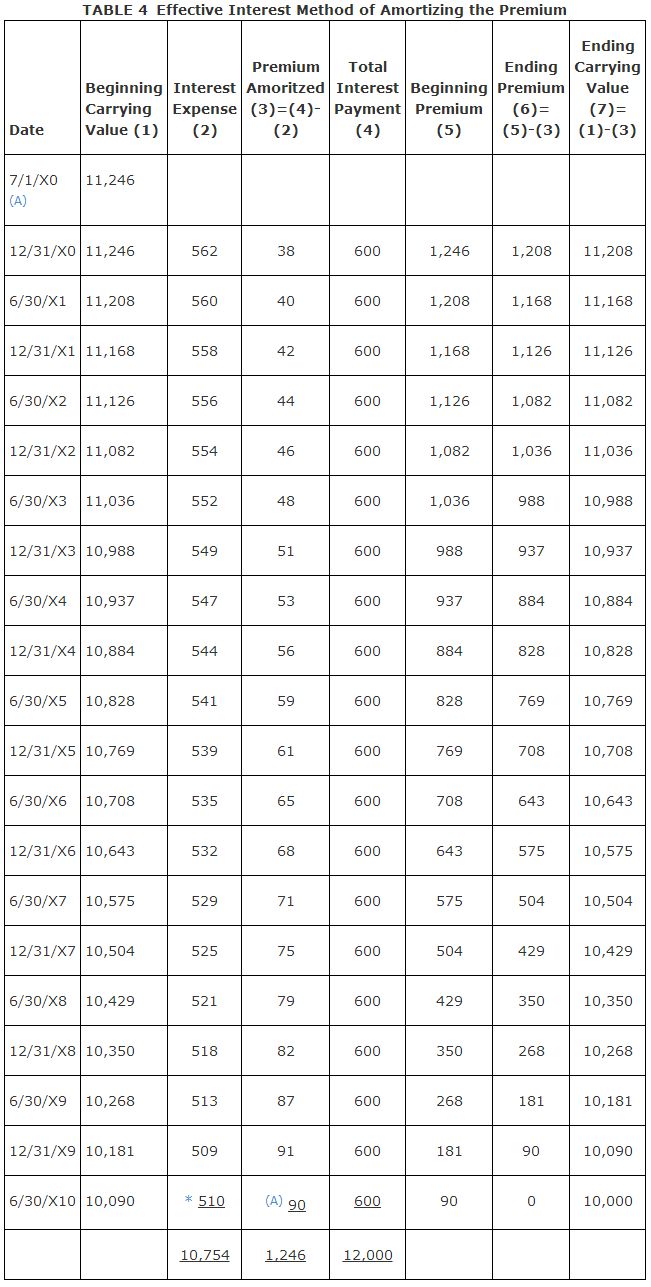

As the premium is amortized, the balance in the premium account and the carrying value of the bond decreases. The amount of premium amortized for the last payment is equal to the balance in the premium on bonds payable account. As with the straight-line method of amortizing the premium, the effective interest method of amortizing the premium results in the premium account's balance being zero at the maturity of the bonds such that the carrying value of the bonds will be the same as the their principal amount. See Table 4 for interest expense and carrying value calculations over the life of the bonds using the effective interest method of amortizing the premium. At maturity, the General Journal entry to record the principal repayment is shown in the entry that follows Table 4 .

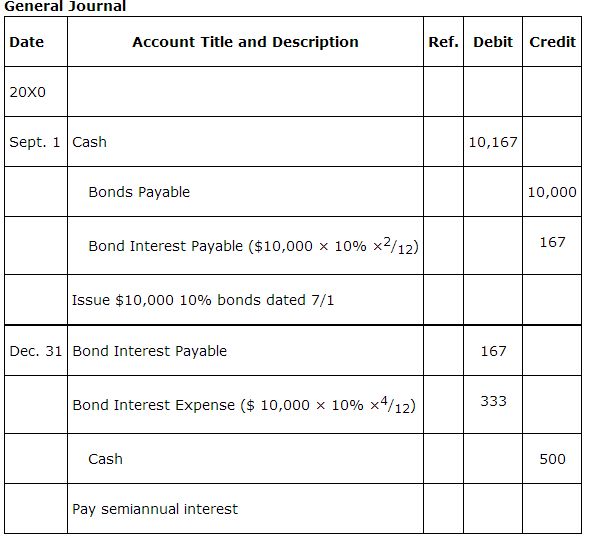

Bonds Issued between Interest dates

If a bond is sold at a time other than on its original issue date, the purchaser of the bond pays the issuing company the price of the bond plus accrued interest from the last interest payment date. This accrued interest is paid back to the purchaser who receives six months of interest at the next semiannual interest payment date. For example, if Lighting Process, Inc. issued $10,000 ten-year 10% bonds dated July 1, 20X0, on September 1, 20X0, the purchaser would pay the $10,000 for the bonds and interest of $167 ($10,000 × 10%2/12) for two months. On December 31, the purchaser would receive a semiannual interest payment of $500 ($10,000 × 10%6/12) as if the purchaser had owned the bonds for the entire six-month period. The entries for these two events would be:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|