The cash that MJM receives from TLM is not recorded on the partnership's books as it is an exchange of an investment by individuals with no assets being given to or taken from the partnership. Therefore, it does not matter whether TLM pays $50,000, $70,000, or $100,000 for MJM's partnership interest, the partnership simply records the change in the partner's capital accounts using the current balance in the MJM, capital account.

Investment in the partnership. If TLM joins the existing partnership (becoming a third partner) by investing cash of $30,000 in the partnership, the partnership must record the additional cash and establish a capital account for the new partner. The amount recorded as capital for TLM depends on his ownership interest in the partnership. If a difference exists between the cash TLM contributes to the partnership and his ownership interest, the difference is allocated to the existing partners. This difference may increase the existing partners' capital account balances (a bonus to existing partners) or be deducted from the existing partners' capital account balances (a bonus to the new partner).

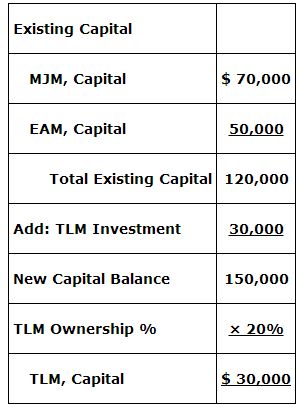

If TLM receives a 20% ownership interest in the partnership for his $30,000 investment, the amount of his initial capital account balance is calculated by adding the $30,000 to the total partnership's capital before his investment and multiplying by 20%, TLM's ownership interest. TLM's capital account would be credited for $30,000 in this case.

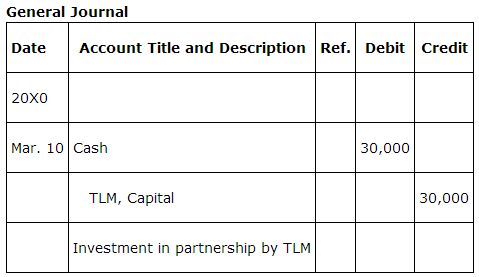

The entry to record TLM's investment into the partnership would be:

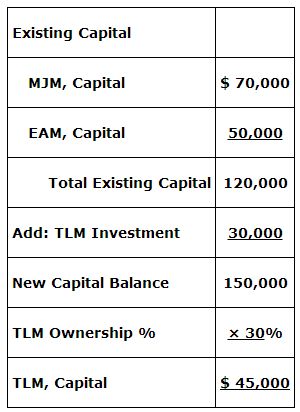

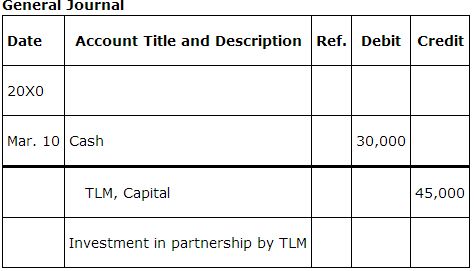

If TLM receives a 30% interest for his $30,000 investment, TLM's capital account would be credited for $45,000.

The $15,000 difference between his initial capital balance of $45,000 and his cash investment of $30,000 must be deducted from the existing partners' capital account balances according to their sharing of gains and losses. If the current ratio for sharing gains and losses is 60%:40%, the partnership would record TLM's 30% interest with the following entry:

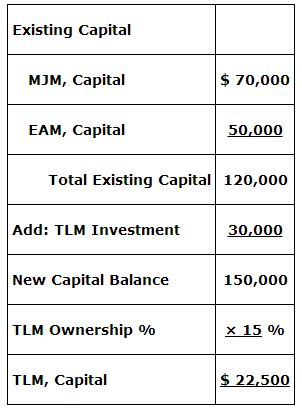

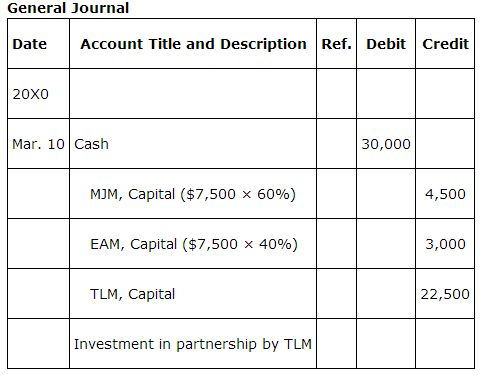

If TLM receives a 15% interest in the partnership for his $30,000 investment, the partnership's cash account would be increased (debited) by $30,000 and TLM's capital account would be increased (credited) by $22,500 (15% × $150,000 new capital balance of partnership).

The remaining $7,500 would be added (credited) to the two existing partners' capital account balances based on their 60%:40% ratio for sharing gains and losses. MJM's capital account balance would increase $4,500 and EAM's capital account balance would increase $3,000. The entry would look like:

Retirement or withdrawal of a partner

If an existing partner wishes to retire or withdraw from the partnership, the partner may be bought out by an existing partner or may receive assets from the partnership. If an existing partner purchases the interest of the retiring partner, the partnership records an entry to close out the capital account balance of the retiring partner and adds the amount to the capital account balance of the partner who purchased the interest. If the partnership gives assets to the retiring partner in the amount of the partner's capital account balance, an entry is made to reduce the assets and zero out the retiring partner's capital account balance. If the retiring partner receives more assets or fewer assets than the partner's capital account balance, the difference is taken from or added to the capital accounts of the remaining partners according to how they share in gains or losses.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|