Manufacturing Financial Statements

Manufacturing companies have several different accounts compared to service and merchandising companies. These include three types of inventory accounts—raw materials, work‐in‐process, and finished goods—and several long‐term fixed asset accounts. A manufacturing company uses purchased raw materials and/or parts to produce a product for sale. At a point in time, the company's inventories consist of raw materials, those materials and parts waiting to be used in production; work‐in‐process, all material, labor, and other manufacturing costs accumulated to date for products not yet completed; and finished goods, the cost of completed products that are ready to be sold. The value of each type of inventory is disclosed in a company's financial statements. The amounts may be shown individually on the face of the balance sheet or disclosed in footnotes.

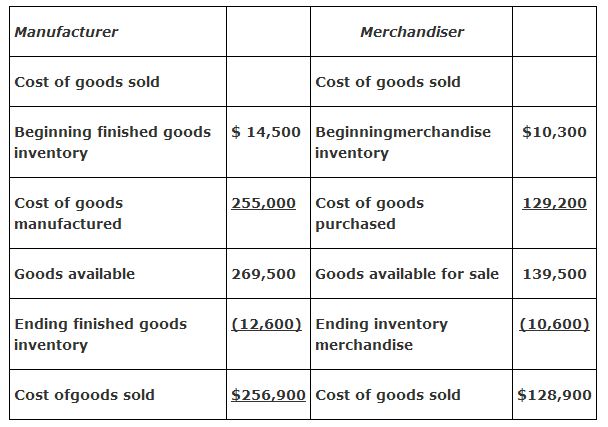

In the long‐term asset section of a manufacturing company's balance sheet, one would expect to find factory buildings and equipment and possibly a small tools account. A manufacturer often has patents for its products or processes. The capitalized costs associated with a patent would be included in the intangible asset section of the balance sheet. The income statement for a manufacturing company is similar to that prepared for a merchandising company. In calculating cost of goods sold, only the finished goods inventory account is used, as shown.