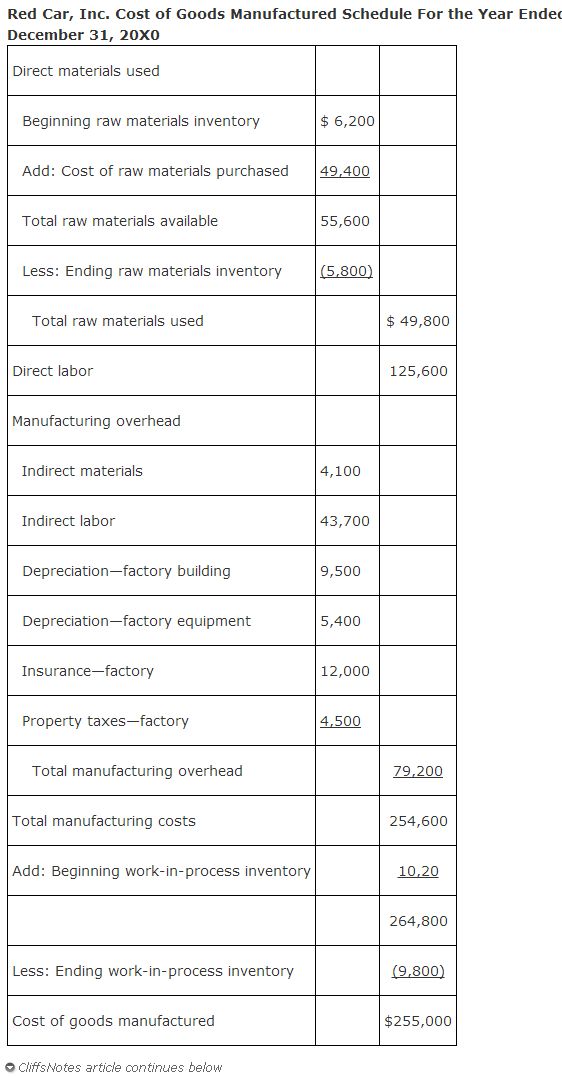

The Cost of Goods Manufactured Schedule

The cost of goods manufactured schedule is used to calculate the cost of producing products for a period of time. The cost of goods manufactured amount is transferred to the finished goods inventory account during the period and is used in calculating cost of goods sold on the income statement. The cost of goods manufactured schedule reports the total manufacturing costs for the period that were added to work‐in‐process, and adjusts these costs for the change in the work‐in‐process inventory account to calculate the cost of goods manufactured.

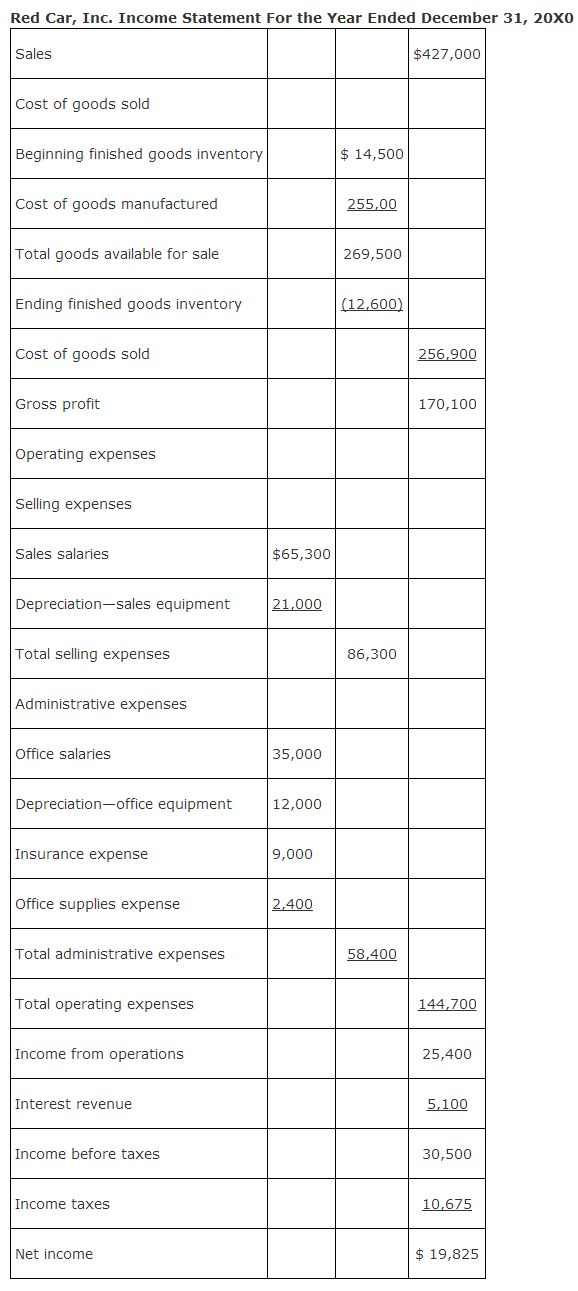

The cost of goods manufactured for the period is added to the finished goods inventory. To calculate the cost of goods sold, the change in finished goods inventory is added to/subtracted from the cost of goods manufactured

.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|